The world of cryptocurrency has changed from a small experiment to a global financial system. In 2025, more people than ever are buying, trading, and storing digital assets. Bitcoin and Ethereum are still well-known, but thousands of other tokens now play roles in payments, investing, gaming, and even decentralized finance (DeFi).

With this growth comes one important question for every investor: which exchange or app is the safest and most reliable for trading crypto? Picking the right platform can mean the difference between a smooth investing experience and a frustrating or risky one.

Today’s exchanges do more than just buy and sell coins. They serve as gateways to the larger crypto economy. This includes staking rewards, NFT marketplaces, debit cards, and access to DeFi apps. At the same time, global regulations are tightening, requiring exchanges to meet higher standards for transparency and security.

This guide highlights the 12 best crypto exchanges and apps for 2025. Whether you’re a beginner buying your first Bitcoin, a trader exploring altcoins, or an experienced user interested in DeFi, this list will help you find the right platform for your needs.

Table of Contents

Beginner’s Guide: How to Choose Your First Crypto Exchange

Before we get to the list, let’s start with a basic explanation.

A crypto exchange is like a digital marketplace where people can buy and sell cryptocurrencies. Some exchanges are centralized, which means they are run by companies like Binance or Coinbase. Others are decentralized, meaning they don’t have a central company controlling them. Instead, users trade directly with each other using smart contracts built on blockchain technology.

For new users, centralized exchanges are usually the best place to start. They are easier to use, have simple sign-up processes, and let you deposit money from banks or credit cards. Decentralized exchanges are more advanced but can feel confusing for someone who is just starting out.

Some common mistakes beginners make when choosing an exchange are:

- Signing up with platforms that charge high or hidden fees.

- Using exchanges that aren’t properly licensed or regulated.

- Being tempted by coins that are popular but not supported by trustworthy exchanges.

- Leaving all your funds on the exchange instead of moving them to a personal wallet.

The best exchange for you depends on your goals. Are you looking to hold crypto for the long term? Do you want to trade regularly? Are you interested in earning rewards through staking? Thinking about these questions can help you pick the right exchange.

What to Look for in a Crypto Exchange (Evaluation Criteria)

When we picked the 12 best exchanges for 2025, we used a clear set of standards.

Here are the main things to consider:

1. Security and Regulation

Your funds are only as safe as the platform you choose. Keep an eye out for:

- Audits that show the exchange has enough money to cover user accounts.

- Insurance in case of security breaches.

- Compliance with your country’s local rules, like the EU’s MiCA or U.S. SEC guidelines.

2. Ease of Use

It’s important that they have a simple, easy-to-use app or website, especially if you’re new to crypto. The best exchanges let you deposit, trade, and withdraw money without needing advanced technical knowledge.

3. Fees and Spreads

Trading costs can cut into your profits. Always make sure you compare the following:

- Fees for buying and selling (maker/taker fees).

- Fees for taking money out.

- Hidden spreads, which are the difference between how much you pay to buy and how much you get when you sell.

4. Regulation and Compliance

Many countries are expected to have clearer rules for crypto exchanges by the end of 2025.

- In the U.S., rules from the SEC and CFTC apply.

- In Europe, the MiCA regulations are coming into effect.

- In Asia, places like Singapore, Japan, and Hong Kong are becoming key hubs.

Fun tip: Regulated platforms are more trustworthy and stable.

5. Variety of Assets

Some exchanges only offer Bitcoin and Ethereum, while others have hundreds of altcoins, stablecoins, and even tokenized stocks. If you like trying out new projects, you’ll want an exchange with a wide range of options.

6. DeFi and Web3 Integration

At the moment, there’s hardly any noticeable difference between centralized and decentralized finance. Modern exchanges today often include:

- Self-controlled wallets that you own.

- Opportunities to earn through staking and yield farming.

- Access to NFTs and the metaverse.

7. Liquidity and Volume

Liquidity means how quickly you can trade without big price changes. High-volume exchanges, like Binance or Coinbase, make trading easier and more affordable.

8. Support and Education

Having a reliable support team, helpful guides, and community resources can make it easier for beginners to start without feeling lost.

Quick Comparison Table: 12 Best Crypto Exchanges and Apps for 2025

| Exchange/App | Founded | Supported Assets | Fees (avg.) | Regulation Status | Best For | Standout Feature |

|---|---|---|---|---|---|---|

| Binance | 2017 | 350+ | 0.1% | Global, facing U.S./EU scrutiny | All-round use | Liquidity + huge ecosystem |

| Coinbase | 2012 | 200+ | 0.5% | U.S. regulated | Beginners | Easy fiat on-ramps |

| Kraken | 2011 | 220+ | 0.16%/0.26% | U.S. + global | Security-minded traders | Proof of reserves pioneer |

| Bybit | 2018 | 400+ | 0.1% | Expanding globally | Derivatives traders | Copy trading & leverage |

| KuCoin | 2017 | 700+ | 0.1% | Not U.S.-regulated | Altcoin hunters | KuCoin Earn + launchpad |

| Gemini | 2014 | 100+ | 0.35% | U.S. regulated | Compliance-first users | Institutional-grade trust |

| OKX | 2017 | 350+ | 0.1% | Expanding global compliance | Multi-featured traders | Built-in DeFi wallet |

| eToro | 2007 | 80+ (crypto + stocks) | 1%+ | U.S./EU regulated | Social traders | Copy trading |

| Bitstamp | 2011 | 85+ | 0.25% | EU regulated | Long-term holders | Oldest reliable exchange |

| Huobi (HTX) | 2013 | 400+ | 0.2% | Asia + global | Asian users | Broad crypto selection |

| Crypto.com | 2016 | 250+ | 0.4% | Multiple licenses | Everyday spenders | Visa card + app ecosystem |

| Robinhood | 2013 | 20+ | Zero commission (spreads apply) | U.S. regulated | Beginners | Stocks + crypto hybrid |

The 12 Best Crypto Exchanges and Apps for 2025

Now let’s take a closer look at each platform, starting with the top three giants.

1. Binance, The Global Leader in Liquidity

Overview:

Binance is the largest crypto exchange in the world by trading volume in 202 Even with regulatory challenges in the U.S. and Europe, it remains a leader in global markets, especially in Asia, Africa, and Latin America.

Key Features:

- Over 350 cryptocurrencies available.

- Low trading fees (0.1% or lower with BNB discounts).

- Advanced trading tools (spot, futures, options, margin).

- Binance Earn: staking, savings, and liquidity farming.

- NFT marketplace and DeFi bridge.

What’s New in 2025:

- More transparent proof-of-reserves reporting.

- Stronger compliance programs for EU MiCA rules.

- Expansion of Binance Pay for global crypto payments.

Best For:

All-round users, whether you’re a beginner, day trader, or altcoin hunter. Binance has the tools you need.

Downsides:

Not fully available to U.S. customers. The interface can be complex for beginners.

2. Coinbase, The Beginner’s Choice

Overview:

Coinbase, founded in 2012, is one of the most trusted platforms for beginners in the crypto space. Being a publicly listed company in the U.S. means it is more accountable and undergoes regular audits.

Key Features:

- Over 200 supported coins.

- Extremely simple mobile app and web platform.

- Fiat currency on-ramps (ACH, debit cards, PayPal).

- Coinbase Learn: educational tools for beginners.

- Coinbase Wallet: self-custody option.

What’s New in 2025:

- Expanded staking services for ETH and major tokens.

- Lowered fees on the advanced Coinbase Pro replacement.

- Strong compliance with U.S. SEC and global rules.

Best For:

Absolute beginners who want a safe and easy way to buy crypto with fiat currency.

Downsides:

Higher fees compared to Binance or Kraken. Limited coin variety compared to KuCoin or Bybit.

3. Kraken, The Security Focused Exchange

Overview:

Founded in 2011, Kraken is one of the oldest crypto exchanges that prioritizes security. Known for its proof-of-reserves audits, Kraken sets a high standard for transparency.

Key Features:

- Over 220 supported assets.

- Spot trading, margin, and futures contracts.

- Kraken Staking: competitive APYs on major tokens.

- 24/7 customer support with high trust ratings.

What’s New in 2025:

- Advanced institutional services for hedge funds.

- Expanded DeFi staking integrations.

- Stronger compliance with both U.S. and European laws.

Best For:

Users who value security, transparency, and compliance with regulations.

Downsides:

The user interface may not be very friendly for beginners. Fees are higher compared to Binance.

4. Bybit – Derivatives Powerhouse with Social Trading

Overview:

Bybit has expanded from a derivatives-only exchange to a complete platform. At the moment, it has gained popularity among traders looking for leverage, futures, and advanced tools. It now also offers spot trading, staking, and a user-friendly mobile app.

Key Features:

- 400+ supported coins.

- Derivatives trading: futures, perpetual contracts, and high leverage (up to 100x).

- Copy trading, allowing beginners to follow professional traders.

- Earn programs: staking, savings, and launchpad tokens.

- Intuitive mobile app with gamified elements.

What’s New in 2025:

- Deeper liquidity pools for futures contracts.

- Expansion of Bybit Earn to compete with Binance and OKX.

- Increased compliance in Asia and Europe.

Best For:

Intermediate to advanced traders, especially those interested in derivatives and copy trading.

Downsides:

- Still restricted in some regions like the U.S.

- High leverage poses risks for beginners.

5. KuCoin – The People’s Exchange

Overview:

KuCoin calls itself the “People’s Exchange” due to its wide variety of altcoins and community-focused approach. It ranks among the top choices for traders interested in new and emerging crypto projects.

Key Features:

- 700+ supported assets, offering one of the largest selections in the industry.

- KuCoin Earn: staking, lending, and savings programs.

- KuCoin Shares (KCS) token for fee discounts.

- KuCoin Launchpad for early-stage tokens.

- Non-custodial KuCoin Wallet for DeFi and NFTs.

What’s New in 2025:

- Improved compliance standards in Asia and Europe.

- Expansion of KuCoin Wallet for Web3 integration.

- Increased focus on proof-of-reserves reporting.

Best For:

Altcoin hunters and traders seeking a wide range of tokens.

Downsides:

- Not licensed in the U.S.

- Higher risks with smaller, less-established coins.

6. Gemini – Compliance First, Trust at the Core

Overview:

Founded by the Winklevoss twins in 2014, Gemini is known for being highly compliance-focused. It is heavily regulated in the U.S. and serves both retail and institutional clients.

Key Features:

- 100+ supported assets.

- Very clean, beginner-friendly interface.

- Gemini Earn for interest-bearing crypto accounts.

- Gemini Custody: institutional-grade storage.

- Strong insurance coverage and regulatory oversight.

What’s New in 2025:

- Expanded services for hedge funds and institutions.

- Improved mobile app with educational features.

- Wider adoption of Gemini Dollar (GUSD) stablecoin.

Best For:

Users who value safety, compliance, and regulation.

Downsides:

- Higher fees than most competitors.

- Fewer supported altcoins compared to Binance or KuCoin.

7. OKX – The Multi-Feature Giant

Overview:

OKX has quietly risen to become one of the most powerful global exchanges, especially in Asia. It combines traditional exchange features with DeFi tools, making it a hybrid platform for 2025.

Key Features:

- 350+ supported assets.

- Spot, futures, and options trading.

- Built-in OKX Wallet for Web3, NFTs, and DeFi access.

- Earn services with flexible staking options.

- Deep liquidity and fast trading engine.

What’s New in 2025:

- Expansion of its DeFi wallet, allowing direct interaction with decentralized apps.

- New compliance measures for Europe’s MiCA framework.

- Growth of its NFT marketplace.

Best For:

Users looking for an all-in-one platform with both centralized and decentralized finance features.

Downsides:

- Not as beginner-friendly as Coinbase.

- Complex interface for casual users.

8. eToro – Social and Copy Trading Leader

Overview:

eToro is known as a multi-asset platform that combines stocks, ETFs, and crypto. Its unique feature is the social trading model that allows you to copy the trades of top investors. By 2025, eToro continues to attract beginners seeking diversification and guidance.

Key Features:

- 80+ cryptocurrencies along with stocks and ETFs.

- Copy trading: follow and automatically replicate expert portfolios.

- User-friendly app that appeals to beginners.

- Built-in social feed to learn from other traders.

- Regulated in multiple regions, including the U.S., UK, and EU.

What’s New in 2025:

- Expanded crypto offerings with more altcoins.

- Improved portfolio analytics for copy traders.

- More DeFi and Web3 integrations for advanced users.

Best For:

Beginners looking for hands-on learning by copying experts, and investors wanting both crypto and stocks in one app.

Downsides:

- Fees are higher compared to Binance or Kraken, at around 1%.

- Less suitable for high-volume, advanced traders.

9. Bitstamp – Oldest Reliable Exchange

Overview:

Founded in 2011, Bitstamp is one of the oldest crypto exchanges still operating. It has a strong reputation for trust and reliability and is especially popular in Europe but has global reach.

Key Features:

- 85+ supported assets, focusing on well-known cryptocurrencies.

- Simple, straightforward trading platform.

- Regulated in the EU, with good compliance and banking relationships.

- Bitstamp Earn: staking services for ETH and other coins.

- 24/7 customer support.

What’s New in 2025:

- Expanded partnerships with European banks.

- Upgraded trading app for mobile-first users.

- More staking and passive income options.

Best For:

Users seeking a safe, simple, and transparent exchange without the need to chase hundreds of altcoins.

Downsides:

- Limited coin selection compared to KuCoin or Binance.

- Interface feels basic compared to modern platforms.

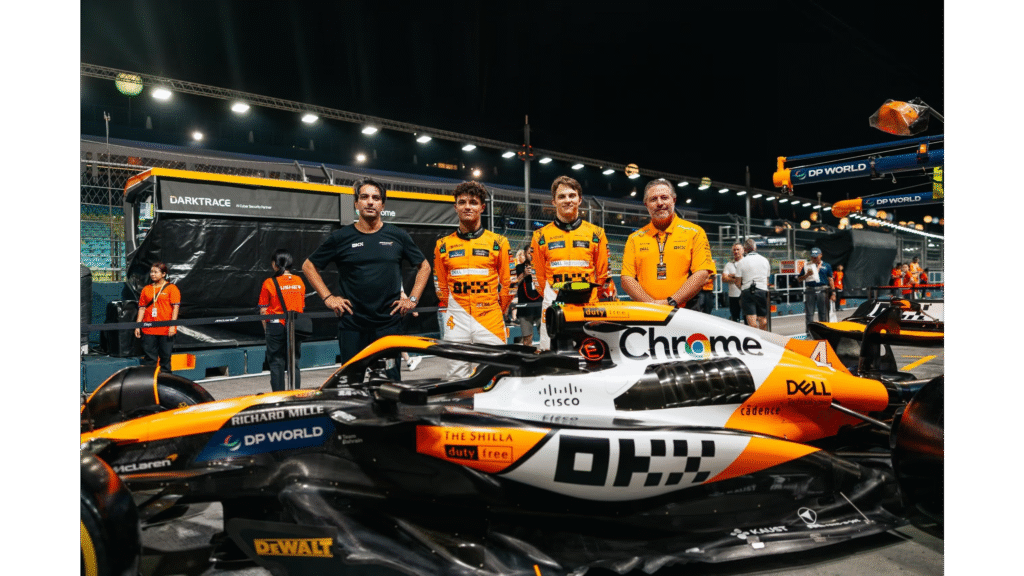

10. Huobi (HTX) – Asian Market Veteran

Overview:

Huobi, now known as HTX, remains a key player in Asia and has expanded its presence globally. It offers hundreds of coins and is appealing for those looking for deep liquidity in Asian markets.

Key Features:

- 400+ supported assets.

- Spot, derivatives, and futures trading.

- HTX token for fee discounts and ecosystem rewards.

- Staking and earning services.

- Popular in China, Singapore, and Southeast Asia.

What’s New in 2025:

- Major compliance changes to meet global regulations.

- Expansion of NFT and GameFi integrations.

- Focus on proof-of-reserves transparency.

Best For:

Traders focused on Asia who want a wide range of crypto options with deep liquidity.

Downsides:

- Less regulatory clarity in the U.S. and EU.

- Reputation has faced challenges due to past regulatory issues.

11. Crypto.com – The Everyday Spending Exchange

Overview:

Crypto.com has established itself as a link between crypto and everyday spending. Known for its Visa card, convenient mobile app, and strong branding, it remains a top choice for retail users in 2025.

Key Features:

- 250+ supported assets.

- Crypto.com Visa Card for cashback in crypto.

- Earning and staking features for passive income.

- Crypto.com Pay: integrated payment solution.

- Regulated in various regions.

What’s New in 2025:

- Increased merchant use of Crypto.com Pay.

- Enhanced security measures following past scrutiny.

- Broader adoption of its CRO token ecosystem.

Best For:

Users wanting to use crypto in daily life and earn rewards while shopping.

Downsides:

- Fees can be higher unless you stake CRO tokens.

- Limited advanced trading features compared to Binance.

12. Robinhood Crypto – Zero-Commission Simplicity

Overview:

Robinhood began as a stock trading app and has gained popularity among crypto investors in the U.S. Its main attraction is zero-commission trading, although spreads still apply.

Key Features:

- 20+ supported cryptocurrencies, including Bitcoin, Ethereum, and selected altcoins.

- Zero commission, but spreads are included in prices.

- User-friendly app designed for beginners.

- Ability to hold both stocks and crypto in one account.

- Simple withdrawal process for supported tokens.

What’s New in 2025:

- Expanded coin offerings beyond the basics.

- Launched Robinhood Wallet with self-custody options.

- Improved educational content for new investors.

Best For:

Complete beginners seeking simplicity and access to both stocks and crypto in one app.

Downsides:

- Limited crypto selection.

- No advanced trading tools or detailed DeFi features.

DeFi and Web3: The New Opportunity

Cryptocurrency in 2025 is not just about buying and selling Bitcoin. The growth of Decentralized Finance (DeFi) and Web3 applications is changing how exchanges work. The leading platforms now provide both centralized services and decentralized tools, creating a mixed ecosystem.

What is DeFi?

DeFi refers to financial applications built on blockchains that work without middlemen. Instead of relying on banks or brokers, smart contracts take care of lending, borrowing, trading, and earning interest.

Examples include:

- Staking: Locking coins to secure networks like ETH, ADA, or SOL to earn rewards.

- Yield farming: Providing liquidity to decentralized exchanges in exchange for fees and token rewards.

- Lending/borrowing: Using assets as collateral to get crypto loans.

How Exchanges Integrate DeFi

Top exchanges now incorporate DeFi directly into their apps:

- Binance offers a DeFi bridge and liquidity farming through Binance Earn.

- OKX features the OKX Wallet, providing users direct access to DeFi apps, NFTs, and cross-chain swaps.

- KuCoin expanded into Web3 with a self-custodial wallet.

- Crypto.com includes a DeFi wallet for staking and decentralized swaps.

This setup allows users to explore DeFi without leaving the security of a centralized platform.

Risks of DeFi

Although promising, DeFi comes with risks:

- Bugs in smart contracts can lead to hacks.

- Liquidity providers may face impermanent loss.

- High volatility exists in newer protocols.

For beginners, a safe approach is to start with staking on regulated exchanges before exploring experimental DeFi platforms.

Why Web3 Matters

Web3 marks the next phase of the internet, where users have ownership of their data, digital identity, and assets. Exchanges that adopt Web3 wallets are getting ready for this future, allowing customers to manage crypto, NFTs, and decentralized apps on one platform.

Regulation and Safety in 2025

The crypto landscape in 2025 is very different from five years prior. Following major exchange failures, governments have tightened regulations. While rules may vary by region, the trend is moving toward increased consumer protection and transparency.

United States

- The SEC regulates crypto assets it considers to be securities.

- The CFTC oversees derivatives such as Bitcoin and Ethereum futures.

- Stablecoin legislation is advancing, requiring issuers to maintain audited reserves.

- Exchanges like Coinbase and Gemini benefit from their compliance-focused approach.

Europe

- The Markets in Crypto-Assets (MiCA) framework is now in place, creating a uniform set of rules across the EU.

- Exchanges operating in Europe must register, hold reserves, and safeguard customer funds.

- This makes Europe one of the safest areas for regulated crypto trading.

Asia

- Japan and Singapore have long been at the forefront of crypto regulation.

- Hong Kong has reopened to crypto firms with new licensing laws.

- China remains cautious, but Chinese users can still access exchanges through offshore platforms.

Global Trends

- Proof of Reserves: Many exchanges now provide regular audits to ensure they hold customer funds on a one-to-one basis.

- Insurance Funds: Platforms like Gemini and Coinbase offer insurance coverage for hot-wallet hacks.

- Travel Rule Compliance: Exchanges must share sender and receiver details for large transactions to combat money laundering.

Safety Tips for Users

Even with tougher regulations, personal responsibility is crucial:

- Not your keys, not your crypto: Keep long-term holdings in hardware wallets.

- Use two-factor authentication (2FA) on every exchange account.

- Be wary of phishing scams and fake apps.

- Stick with exchanges that have proven track records and regulatory compliance.

Decision Guide: Which Exchange Fits You Best?

Not every exchange is perfect for everyone. The best choice depends on your goals, risk tolerance, and location. Here’s a simple breakdown:

Best for Beginners: Coinbase & Robinhood

- Coinbase provides easy fiat on-ramps, a clean design, and strong compliance.

- Robinhood is very simple, especially for those already investing in stocks.

Best for Security: Kraken & Gemini

- Kraken stands out with proof-of-reserves and a long history of transparency.

- Gemini is heavily regulated and insured, making it ideal for safety-first users.

Best for Altcoin Hunters: KuCoin & Bybit

- KuCoin lists hundreds of smaller tokens and early-stage projects.

- Bybit supports a wide range of assets, copy trading, and derivatives.

Best for Advanced Trading: Binance & OKX

- Binance has the deepest liquidity and the most advanced features.

- OKX offers a mix of centralized and decentralized finance tools, great for hybrid traders.

Best for Passive Income (Staking/Earn): Crypto.com & Binance

- Crypto.com’s Earn feature pairs with its Visa card for real-world rewards.

- Binance Earn provides flexible staking, liquidity farming, and lending.

Best for U.S. Users: Coinbase, Gemini, & Robinhood

- These exchanges are licensed and regulated, giving more peace of mind to American investors.

Best for Asian Users: Huobi (HTX) & OKX

- Both exchanges offer deep liquidity and wide services in Asia’s growing markets.

Best for European Users: Bitstamp

- Bitstamp’s EU regulation and banking relationships make it a strong option for Europeans.

Safety Tips Recap: Protecting Yourself in 2025

Even the best exchange isn’t completely safe if users make mistakes. Keep these rules in mind:

1. Not Your Keys, Not Your Crypto

- Exchanges are for trading, not for storing all your assets.

- Use hardware wallets (Ledger, Trezor) for long-term holdings and storing your crypto assets.

2. Enable Strong Security Features

- Turn on two-factor authentication—ideally with an authenticator app, not SMS.

- Use anti-phishing codes if your exchange offers them.

3. Beware of Scams

- Double-check URLs—phishing websites often look like real exchanges.

- Never share your private keys or recovery phrases.

4. Stay Updated on Regulations

- Make sure the exchange is licensed in your area.

- Be cautious of platforms operating in unclear legal zones.

5. Diversify Across Platforms

- Don’t put all your assets on one exchange.

- Spreading across two to three platforms lowers risk if one has downtime or issues.

FAQs

Q1. Which crypto exchange is safest in 2025?

Kraken and Gemini are often seen as the safest due to their proof-of-reserves audits, strong compliance, and insurance coverage. Coinbase also ranks high for U.S. users.

Q2. What’s the difference between centralized and decentralized exchanges?

Centralized exchanges (CEX) are operated by companies like Binance or Coinbase. They manage custody, compliance, and customer service. Decentralized exchanges (DEX) run on blockchain smart contracts, allowing users to trade without intermediaries. Beginners usually start with CEX before trying DEX.

Q3. Can beginners use DeFi apps?

Yes, but with caution. Start with staking options from regulated exchanges before trying independent DeFi platforms. DeFi can be rewarding but comes with higher risks of hacks and smart contract failures.

Q4. Which exchange has the lowest fees?

Binance, KuCoin, and Bybit have some of the lowest trading fees, which can drop to 0.1% or less with native token discounts. Coinbase and eToro charge higher fees but are easier for beginners.

Q5. Do I need multiple exchanges?

It depends on your goals. Many investors use one exchange for fiat on-ramps, like Coinbase, another for altcoins, like KuCoin, and a third for spending, like Crypto.com. Using multiple platforms can also lower risk.

Q6. What happens if an exchange gets hacked?

Top exchanges now have insurance funds, but payouts differ. Generally, regulated exchanges like Gemini, Coinbase, and Bitstamp provide more protection than unregulated ones. This makes moving funds to a self-custody wallet crucial.

Conclusion

The crypto exchange you select in 2025 will influence your journey as an investor. With many platforms competing, it’s important to find one that balances security, usability, regulation, and features that fit your goals.

- If you’re a beginner, start with Coinbase or Robinhood for ease of use.

- If you’re looking for altcoins or advanced features, Binance, KuCoin, or OKX are excellent options.

- If trust and safety are your top priorities, choose Kraken, Gemini, or Bitstamp.

- For spending crypto in daily life, Crypto.com is a solid option.

The industry is changing quickly. DeFi, Web3 wallets, and tighter regulations are shaping the future. Exchanges that combine compliance and innovation will lead the charge.

Remember the golden rule: “Not your keys, not your crypto.” Use exchanges as stepping stones, but keep your assets secure with self-custody whenever you can.

Start small, stay informed, and select platforms that match your strategy. The right exchange in 2025 can be more than just a trading platform—it can be your launchpad into the future of finance.