Ever been stuck with an emergency—say your car breaks down, or you have a surprise bill—and your bank account is echoing? (Yes, I hear that echo.) That’s when a fast loan app can feel like a superhero swooping in, cape and all.

In this guide, I’ll walk you through 10 of the best loan or cash-advance apps in the US that are easy to use, pretty fast, and can help when you really need money ASAP. I’ll tell you how they work, their perks, and what you need to apply.

Table of Contents

What Makes a Loan App “Best” Anyway?

Before we dive in, here are the qualities I used to pick these apps (so you’re not stuck with a bad deal):

- Speed: How fast you can get money—minutes, hours, or days.

- Easy to qualify: Not asking for too much (bad credit, few documents).

- Low surprises: Clear fees, no hidden traps.

- User-friendly: Simple app, easy steps.

- Legit & safe: Proper licenses, good reviews, trustworthy.

If an app doesn’t check enough of those boxes, I skipped it. You deserve something that helps, not hurts.

Are These Apps Safe and Real?

Good question. Some “loan apps” are just scams dressed up in nice clothes. I only include apps that:

- Have a real app in iOS or Android

- Are described in trustworthy sources

- Use transparent terms

- Don’t demand insane paperwork

Still: always read the small print. Never give your Social Security number or sign anything you don’t understand. If something smells fishy, back away.

The 10 Best Loan / Advance Apps in the US (That Can Help Fast)

Here are 10 apps people use when they need money quickly. I’ll tell you what makes each good (and what to watch out for).

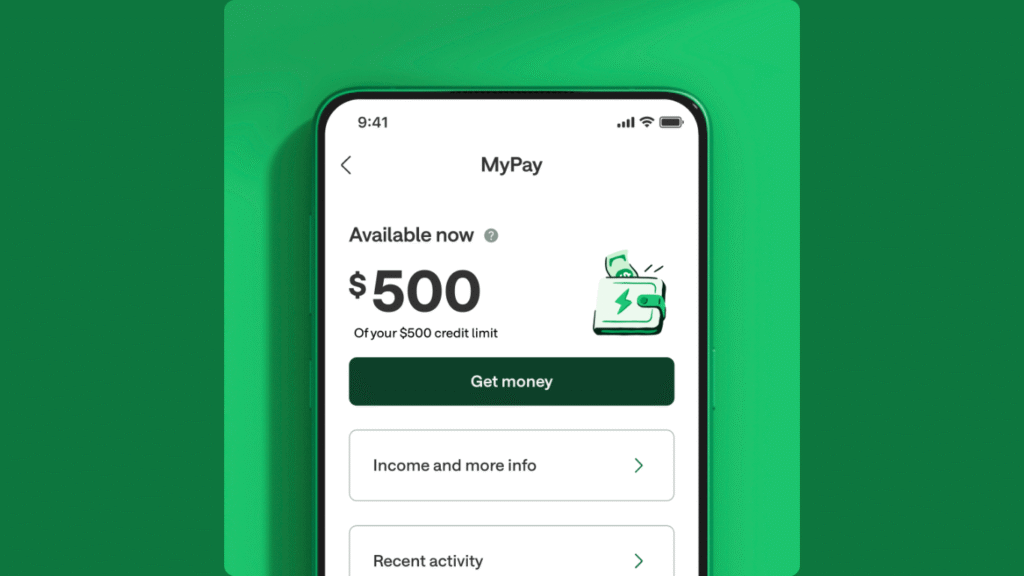

1. Chime Instant Loans / SpotMe / MyPay

- What it does: Chime is a banking app that has features like Instant Loans where eligible users can borrow up to $500.

Also SpotMe lets you overdraft (spend more than your balance) up to $200 without a fee.

MyPay lets you take an advance from your paycheck before payday. - Why people like it: No credit check for Instant Loans.

The payments are broken into 3 months, so it’s less painful.

With SpotMe, you don’t get hit with overdraft fees immediately. - How to apply / use it:

- Get a Chime account and set it up with direct deposit.

- If you’re eligible, the app will show Instant Loans or MyPay as options.

- Accept the offer, and the money is deposited.

- Pay back in monthly installments (for Instant Loans).

- What you need: Must be a Chime customer, direct deposit set up, some transaction history.

- Watch out for: Even if there’s no credit check, the fees can be high. Also, some users report the feature disappears depending on state.

2. EarnIn

- What it does: EarnIn lets you get paid before your payday by accessing the wages you’ve already earned.

You can “Cash Out” up to $150 per day (subject to limits). - Why people like it: It doesn’t call itself a loan—no interest, no credit check, no mandatory fees.

It’s helpful when you’ve worked hours but payday is far away. - How to apply / use:

- Download EarnIn and link your bank account.

- Verify your identity and your job (they may ask you for proof of income).

- Request “Cash Out” for money you’ve already earned.

- On payday, the app will automatically take out what you borrowed.

- What you need: Proof of income, linked bank account, work history.

- Watch out for: If you use the “Lightning Speed” option, there is a fee which can make the effective cost high. Also, it may take time to get fully approved.

3. Dave

- What it does: Dave gives you cash advances when your bank balance is low. It’s kind of like a safety net.

- Why people like it: It helps avoid overdraft fees, gives small amounts quickly.

- How to apply / use:

- Sign up and link your bank account.

- Check if you’re eligible for an advance.

- Request what you need (small amount).

- Repay when your next paycheck hits.

- What you need: Linked bank, some history of deposits.

- Watch out for: The fees can add up if you use it often.

4. Brigit

- What it does: Brigit offers short-term advances, tracks your spending, and gives alerts so you don’t overdraft.

- Why people like it: It helps with cash flow and gives you warnings before things go bad.

- How to apply / use:

- Download Brigit and connect your bank.

- See your eligibility.

- Request an advance.

- Repay when due.

- What you need: Bank account, proof of income.

- Watch out for: Membership fees in some cases.

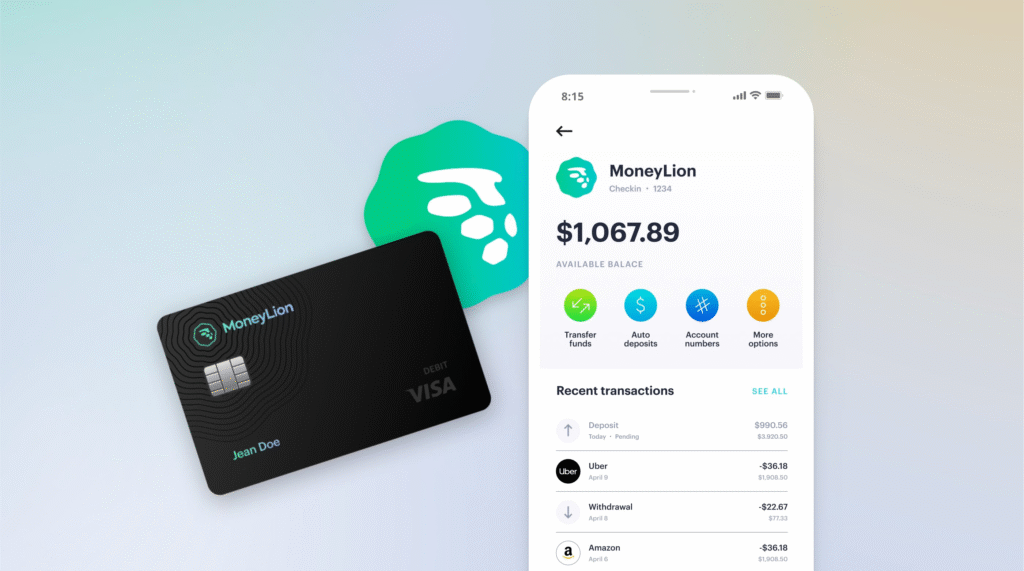

5. MoneyLion

- What it does: More than just a loan app—MoneyLion offers credit builder tools, small cash advances, investing, etc.

- Why people like it: Combines many tools in one place, so you don’t have ten different apps.

- How to apply / use:

- Get the MoneyLion app.

- Build your profile and see what you qualify for.

- Apply for a cash advance or small loan.

- What you need: Bank account, identity proof.

- Watch out for: The more services you use, the more complexity in fees.

6. Cleo

- What it does: Cleo is a chatbot-style app. You can ask it for small cash advances, and it teases you about your spending habits (yes, it’s sassy).

- Why people like it: It’s fun, simple, and sometimes helpful when you need a small boost.

- How to apply / use:

- Install Cleo and link your account.

- Ask the bot for an advance.

- Pay it back on payday.

- What you need: Bank account, proof of income.

- Watch out for: Because it’s fun, you might forget the cost if you don’t watch it.

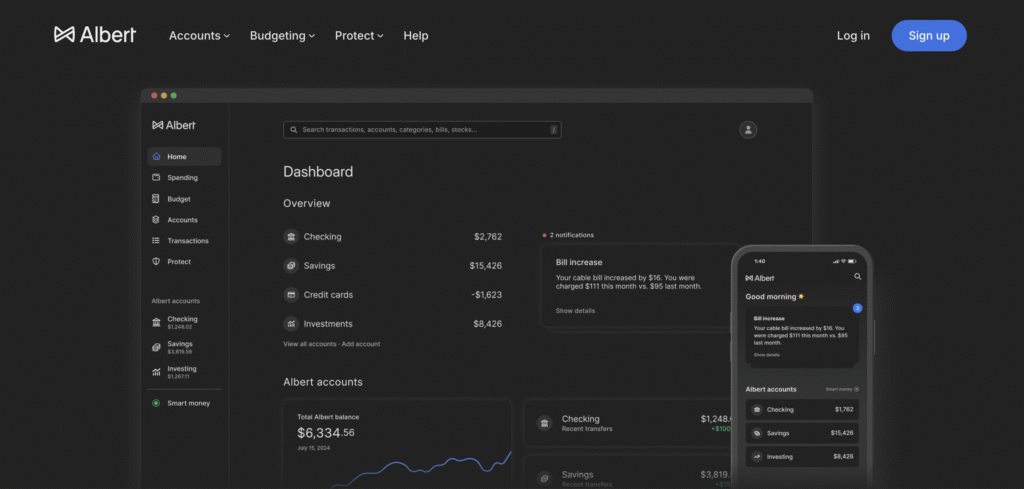

7. Albert

- What it does: Albert helps manage your money, saves for you, and gives you small advances when you’re short.

- Why people like it: It’s like having a budget buddy + loan app.

- How to apply / use:

- Sign up for Albert and link your account.

- Check “Advance” option if eligible.

- Use it, then pay later when your income comes.

- What you need: Bank account, proof of income.

- Watch out for: There may be small fees or limits on advances.

8. SoFi (for smaller emergency loans)

- What it does: SoFi is more famous for student and personal loans, but they also offer smaller, fast options in some cases.

- Why people like it: If you already have a relationship with SoFi, it’s convenient.

- How to apply / use:

- Log in to SoFi, check “loans” or “cash advances.”

- Apply and get decision.

- Funds go to your bank.

- What you need: Good credit helps, proof of income.

- Watch out for: Because it’s more “formal,” it might take longer.

9. Possible Finance

- What it does: Designed for folks with bad credit or no credit. Gives small installment loans with easier approval.

- Why people like it: More forgiving than many traditional lenders.

- How to apply / use:

- Download the app, fill info.

- If eligible, choose how much to borrow.

- Funds are sent, and you pay in small installments.

- What you need: Identity, bank account.

- Watch out for: Interest or fees might be higher than you expect.

10. Cash App Borrow

- What it does: If you use Cash App, there’s a hidden feature (for some users) to borrow small amounts.

- Why people like it: If you’re already using Cash App, it’s fast and easy.

- How to apply / use:

- Open Cash App.

- See if “Borrow” or “Loan” is offered.

- Accept, and money moves to your Cash App balance or bank.

- What you need: Verified Cash App account, regular deposits.

- Watch out for: Not everyone qualifies; amounts are small.

What You’ll Usually Need to Apply

When you try to borrow money from these apps, here’s what they often ask for:

- A bank account (so they can send money and get repaid)

- Proof of income (pay stubs, recent deposits, or job info)

- A photo ID (driver’s license, state ID)

- Some apps may ask permission to see your bank history

If you don’t have one of those, some apps won’t approve you. That’s okay—just look at the ones you qualify for.

How to Pick the Right App for YOU

This is your money life, so don’t pick blindly. Ask yourself:

- Do I just need $50 or do I need $500?

- Can I pay it back quickly?

- Do I have enough income to be approved?

- Do I want to avoid high fees?

- Do I need something now, or can I wait a day or two?

Pick what works, not what looks “cool.”

Tips for Using Loan Apps Wisely (So You Don’t Dig a Deeper Hole)

- Borrow only what you really need.

- Pay back on time, or you’ll get hit with more fees.

- Use these apps occasionally—not every month.

- Keep track of what you borrowed and when it’s due.

- If you have multiple apps, don’t borrow from all of them at once.

Conclusion – You’re More Powerful Than You Think

When life throws you a surprise bill or a broken-down car, you don’t have to panic. These apps exist because you deserve help when you need it the most. They’re not perfect. But used wisely, they can be a helpful tool in your toolbox.

Pick the app that fits your situation, read the terms, borrow smart, and remember: this is a short bridge—not a long tunnel. You’ve got this.

FAQs

Will using these apps hurt my credit?

Some do, some don’t. Apps like Chime Instant Loans or MyPay may report to credit bureaus (which helps if you pay on time). Others just take from your paycheck without credit checks. Always check the app’s rules.

Can I use them if I don’t have good credit?

Yes! Many of these apps are built for people with fair or low credit. That’s one of their main features.

How fast is “fast”?

Sometimes minutes, sometimes same day. But in many cases it takes a few hours or up to 1–2 business days.

Do I need a job?

Yes, usually. They want proof you’re bringing in money. If you have irregular income, you may qualify but it’s harder.

Are there hidden fees?

Sometimes. Especially if you pick “instant transfer” or “speed up my payment.” Read the fine lines.

Which app is absolutely best?

No one-size-fits-all. For small advance with no credit check, Chime’s Instant Loans or EarnIn are top picks for many. But your best app depends on your credit, income, and how fast you need the money.