Amsterdam, Sept. 26, 2025 – Nine leading European banks, including ING and UniCredit, announced Thursday they are joining forces to launch a euro-backed stablecoin in 2026, aiming to provide a credible alternative to the fast-growing U.S. digital token market.

Quick Takeaways

- Consortium of nine banks led by ING and UniCredit to launch euro stablecoin.

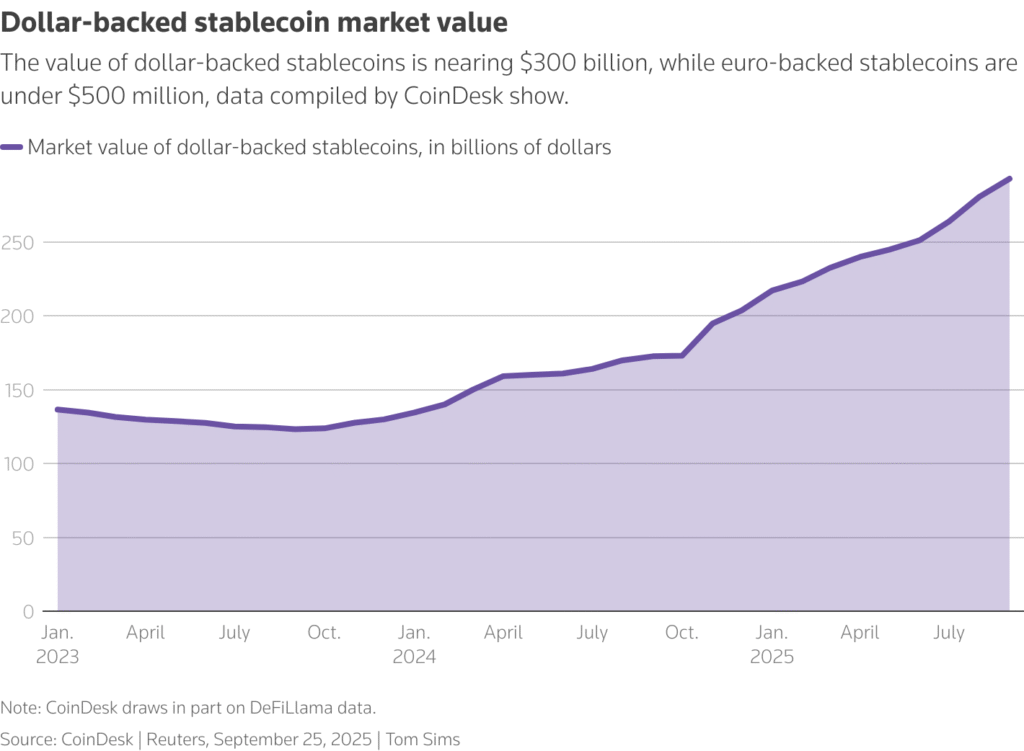

- Stablecoin market imbalance: Dollar-pegged tokens dominate nearly $300 billion in circulation, while euro tokens total just $620 million.

- ECB scepticism: European Central Bank remains wary of private stablecoins, pushing instead for a digital euro.

- Strategic autonomy goal: Banks say the token will strengthen Europe’s independence in payments.

- Launch timeline: New Amsterdam-based company plans rollout in the second half of 2026.

A Pushback Against U.S. Dominance

Stablecoins, designed to maintain a fixed value by being backed with traditional currencies, have grown popular among crypto traders and are increasingly used in digital payments and cross-border transactions. But the market is dominated by dollar-pegged tokens, leaving the euro far behind.

European banks behind the new venture — including ING, UniCredit, Banca Sella, KBC, DekaBank, Danske Bank, SEB, Caixabank, and Raiffeisen Bank International — say their effort will bring balance. “The initiative will provide a real European alternative to the U.S.-dominated stablecoin market, contributing to Europe’s strategic autonomy in payments,” the group said.

The project’s headquarters will be based in Amsterdam, with leadership appointments expected soon. The launch is targeted for the second half of 2026.

ECB Stays Cautious

Despite industry enthusiasm, the European Central Bank has repeatedly warned that privately issued stablecoins pose risks for monetary policy and financial stability. ECB President Christine Lagarde urged lawmakers earlier this year to back a digital euro instead, arguing that a central bank–backed version of the single currency would be safer.

Commercial banks, however, worry that a digital euro could drain deposits away from them and into ECB-backed wallets, reducing their lending capacity — a concern echoed in policy debates.

Europe Under Pressure

According to the Bank of Italy, global stablecoin issuance is close to $300 billion, yet euro-pegged stablecoins account for only $620 million. A report by Deutsche Bank warned that emerging economies are rapidly adopting dollar-backed tokens in place of local deposits. “Countries should adopt stablecoins or risk being left behind. Europe is under particular pressure,” the report noted.

French lender Societe Generale has already experimented with a euro stablecoin through its SG-FORGE unit, but adoption has been limited, with just €56 million in circulation. By contrast, dollar-based tokens from U.S. firms continue to attract significant demand.

What This Means for Everyday Readers

For individuals and businesses in Europe, a euro-denominated stablecoin could mean faster, cheaper cross-border payments and an alternative to dollar-backed tokens. But questions remain over regulation, security, and whether the European Central Bank will eventually overshadow private efforts with its own digital euro.

Bottom line: Europe’s banks want to close the gap in the global stablecoin race. Whether their initiative can compete with the scale of U.S. offerings — and win trust from regulators — remains to be seen.

For more on how global finance shifts affect your money, visit Investment-Guru.net for expert insights in plain English.