Germany’s private sector activity expanded at the quickest pace in 16 months this September, fueled by a revival in services that offset further weakness in the nation’s factories.

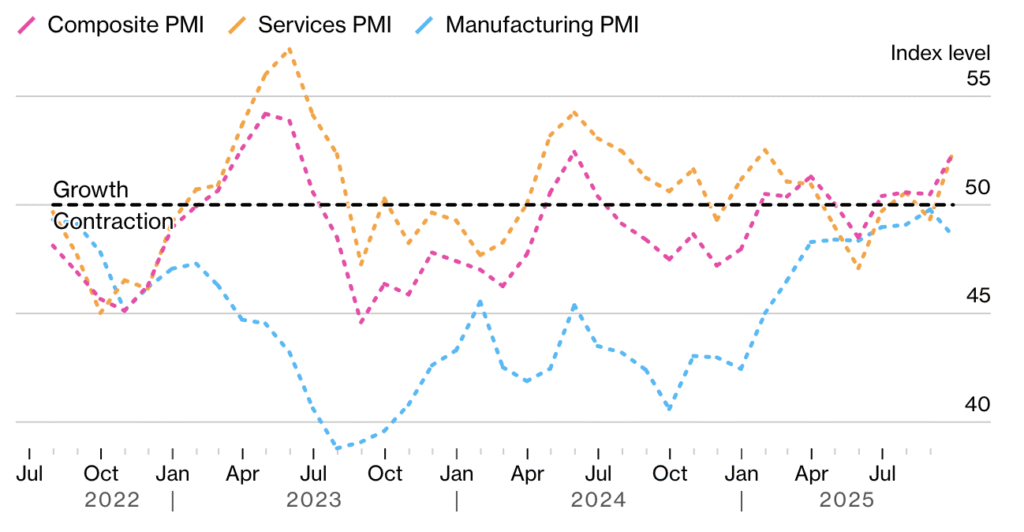

According to data released Tuesday, S&P Global’s Composite Purchasing Managers’ Index (PMI) climbed to 52.4 from 50.5 in August — comfortably above the 50 threshold that separates expansion from contraction. Analysts had only expected a modest improvement to 50.7.

Services Shine, Factories Struggle

“The services sector picked up a bit of steam in September,” noted Cyrus de la Rubia, economist at Hamburg Commercial Bank. Still, he warned that “trouble seems to be brewing in manufacturing,” with new orders dropping sharply after seven months of continuous production gains.

The broader figures offer a rare bright spot for Europe’s largest economy, which has recently been grappling with sluggish growth. After output fell 0.3% in the second quarter, forecasts suggest only slight gains for 2025 overall.

Policy and Trade Tailwinds

The Bundesbank expects GDP to edge higher between July and September, partly as trade frictions with the U.S. ease following a new tariff accord between the European Union and President Donald Trump. Improved sentiment among German firms has now held for five consecutive months.

Still, de la Rubia cautioned that underlying demand remains soft: “Orders are under pressure, especially in manufacturing but also in services. Despite promises of billions in investment incentives, business expectations for the year ahead are muted.”

What This Means for Everyday Readers

For workers and small businesses, the mixed picture highlights two realities:

- Services jobs — in areas like hospitality, consulting, and digital services — are showing resilience.

- Manufacturing-linked jobs remain vulnerable if foreign and domestic demand continues to falter.

Households may not feel immediate relief, but the stabilization in services could help prevent deeper downturns in hiring. Investors, meanwhile, are watching PMI trends closely as early signals of whether Europe’s largest economy can turn the corner.

Quick Takeaways

- German PMI jumped to 52.4 in September — best in 16 months.

- Services led the rebound, while manufacturing orders fell.

- Bundesbank sees slight Q3 growth as U.S. trade drag eases.

- Business sentiment still subdued despite planned investments.

Bottom line: Germany’s services sector is keeping the economy afloat, but cracks in manufacturing could limit how long the recovery lasts.