New York, Sept. 26, 2025 – After months of shifting money into Europe and Asia, global investors are making a sharp U-turn — pouring billions back into U.S. stocks and bonds. A mix of optimism around artificial intelligence and expectations for deeper Federal Reserve rate cuts has reignited Wall Street’s appeal, leaving “rest-of-the-world” strategies on pause.

Quick Takeaways

- Investor U-turn: Global fund managers are reversing earlier moves away from U.S. markets.

- AI boom + Fed cuts: Analysts see rate cuts and tech giants fueling growth.

- Flows rebound: After pulling $78 billion earlier this year, investors bought back into U.S. equities in August.

- Europe loses steam: Euro zone funds that hit $3B in April shrank to $563M by August.

- Risks remain: Trade tariffs and echoes of the dot-com bubble weigh on sentiment.

Wall Street’s Surprise Comeback

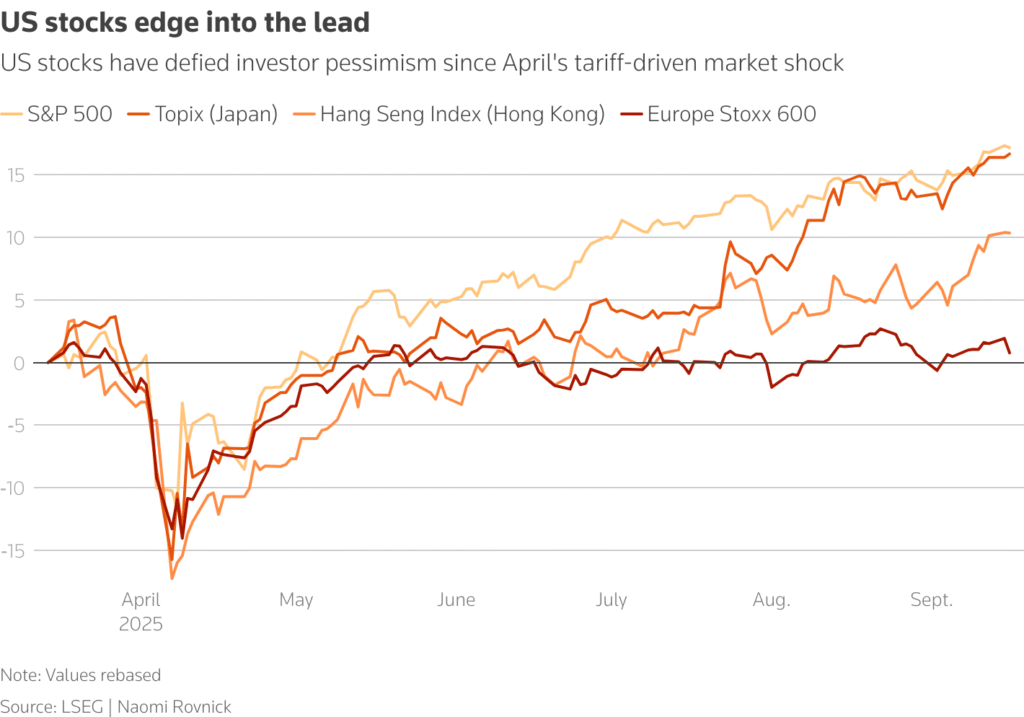

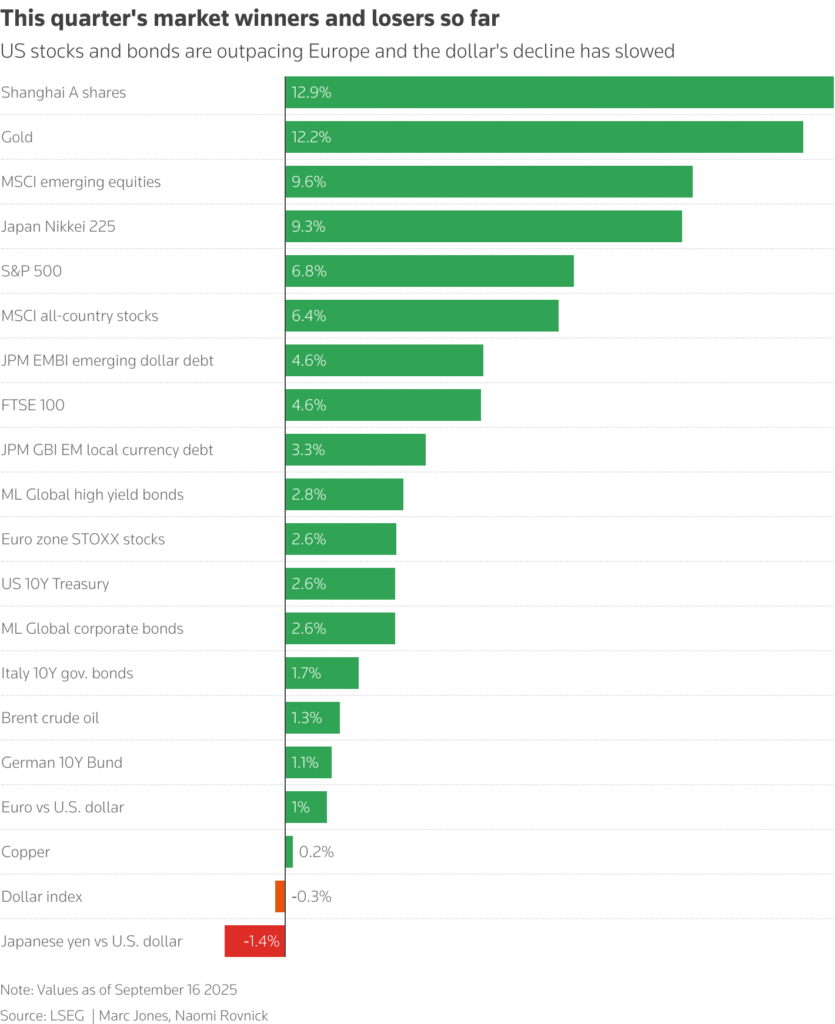

U.S. stocks have surged 7% in the past quarter, driven by AI juggernauts like Nvidia and boosted by expectations for 110 basis points of Fed cuts by the end of 2026. The Federal Reserve last week cut rates for the first time since December, helping lift confidence among fund managers.

“There’s no need for pessimism right now about the U.S.,” said Salman Ahmed, global head of macro strategy at Fidelity International. He noted that small-cap stocks, which usually benefit from lower rates, look particularly attractive.

Big Investors Change Course

Back in June, a Bank of America survey showed managers were the most bearish on U.S. stocks in years. By September, however, those same investors were buying U.S. equities and the dollar again, while reducing exposure to Europe, emerging markets, and the UK.

Data from Lipper showed $78 billion left U.S. equities in spring, only for flows to rebound in August. Barclays analysis found weekly inflows into U.S. equity funds hit nearly $58 billion — the strongest this year — compared with just $1 billion into euro zone funds and none into Japan.

“It’s hard to get away from the U.S.,” said Van Luu of Russell Investments. “Especially with equities.”

Treasuries Back in Fashion

The bond market is also reflecting the pivot. U.S. Treasury yields have fallen as euro zone borrowing costs rise, lifting demand for American debt. Meanwhile, the dollar — which had its weakest first half in 20 years against the euro — has begun stabilizing.

Risks Still Linger

Not everyone is convinced the U.S. rally will last forever. Some warn that Trump’s tariffs could stoke inflation and weigh on growth. Others see worrying parallels with the dot-com bubble.

“The momentum is there, but let’s take it quarter by quarter,” said Fidelity’s Ahmed. He compared today’s AI-fueled optimism to “shades of 2000,” when soaring tech stocks eventually crashed.

U.S. households now hold a record 68% of their wealth in equities, according to Capital Economics. “That should ring alarm bells, even if the market keeps rising,” the consultancy noted.

Still, investors like Foresight Group’s Mayank Markanday believe much of the $7.7 trillion parked in U.S. money market funds will eventually move into domestic stocks or corporate bonds as rates fall.

“The only positive for the rest of the world is valuations look cheaper,” he said. “But it’s not the time to ditch U.S. exposure.”

What This Means for Everyday Investors

For individual investors, the global rush back into U.S. markets underscores the continued dominance of Wall Street. While international diversification remains smart, momentum, liquidity, and the AI boom are pulling capital back into U.S. assets. The question is whether today’s rally is a sustainable trend — or another bubble waiting to pop.

Bottom line: The U.S. is once again at the center of the global investing stage. But just like in the early 2000s, staying informed and cautious may be as important as chasing returns.

Get more insights on markets, investing, and personal finance at Investment-Guru.net.