Markets don’t exist in a vacuum. Every time you buy groceries, fill your car with gas, or invest in stocks, government decisions have already shaped the prices, rules, and choices you face. Governments influence markets to keep them stable, fair, and working for the public. Without some guidance, markets can spiral into chaos, leaving consumers unprotected and economies vulnerable.

Think about it: taxes change how much you take home from your paycheck. Interest rates affect the cost of borrowing for a house or car. Regulations decide how safe your food, drugs, and workplaces must be. Trade policies affect the prices of imported goods like electronics or clothing. In short, government decisions touch nearly every corner of the economy.

In this article, we’ll explore how governments influence markets, the tools they use, real-world examples, and the benefits and risks of this power.

Table of Contents

The Role of Government in Markets

At its core, the government plays three main roles in markets: regulator, protector, and participant.

- As a regulator, the government sets the rules of the game. These include laws against unfair competition, safety standards for products, and rules for financial markets. Without these, powerful players could dominate markets, leaving smaller businesses and consumers at a disadvantage.

- As a protector, the government ensures stability and fairness. For example, it provides unemployment benefits during downturns, sets a minimum wage, and offers protections for consumers against fraud. These measures make markets more predictable and safer for participants.

- As a participant, the government is also a market player itself. It buys goods and services, builds roads, runs schools, and in some countries, even owns key industries like energy or transportation. Through this spending, governments create demand, jobs, and growth.

The challenge is balance. Too little government involvement can lead to unsafe conditions, monopolies, or financial crises. Too much interference can stifle innovation, discourage investment, and slow economic growth. Successful economies often lie in the middle—markets are free to operate, but governments step in where oversight and support are necessary.

How Governments Influence Markets

1. Fiscal Policy

Fiscal policy is the way governments use spending and taxes to influence the economy. Think of it as the government’s budget plan for shaping demand.

- Government spending: When a government invests in roads, schools, or healthcare, it creates jobs and pumps money into the economy. This boosts demand for goods and services. During a slowdown, governments often increase spending to stimulate growth.

- Taxation: Taxes affect how much money households and businesses have left to spend or invest. Lower taxes put more cash in people’s pockets, encouraging spending. Higher taxes can slow down demand but also help control inflation and fund public services.

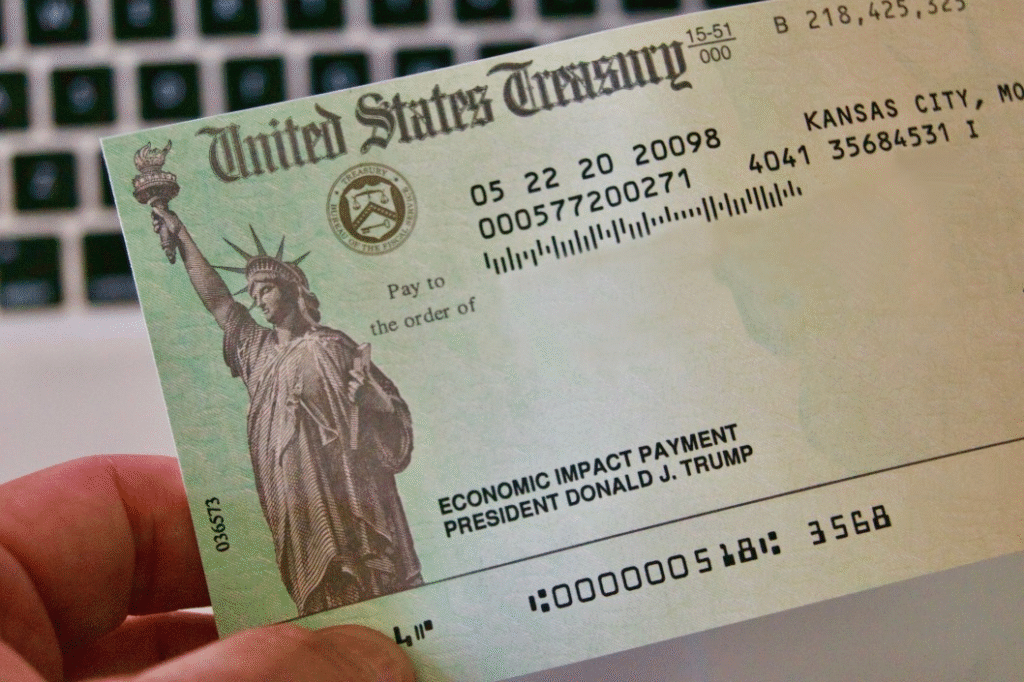

Example: During the COVID-19 pandemic, many governments gave out stimulus checks and unemployment support. This direct spending put money into people’s hands, helping them pay bills and keeping businesses afloat. That’s fiscal policy in action.

Fiscal policy can be powerful, but it comes with trade-offs. Too much spending can increase government debt or push inflation higher. Too little spending during a downturn can prolong unemployment and slow recovery.

2. Monetary Policy

Monetary policy is about controlling the supply of money and interest rates. While it is usually carried out by central banks, it works hand-in-hand with government goals.

- Interest rates: When central banks lower rates, borrowing becomes cheaper. This encourages businesses to invest and consumers to buy houses, cars, or other goods. When they raise rates, borrowing costs increase, slowing down demand and cooling inflation.

- Money supply: Central banks use tools like open market operations, reserve requirements, and lending rates to increase or decrease the amount of money circulating in the economy.

Example: After inflation spiked in 2022, the U.S. Federal Reserve raised interest rates several times. This made loans more expensive, which reduced consumer demand and helped bring inflation under control.

While fiscal policy is about taxes and government budgets, monetary policy focuses on money itself. Together, they form the two main levers governments use to guide markets.

3. Regulation and Deregulation

Regulation is how governments set rules for markets to protect consumers, workers, and the environment. Without these rules, businesses might cut corners, create unsafe products, or exploit workers in pursuit of profit.

- Consumer protection: Governments require food safety labels, regulate medicines, and set standards for cars and electronics to keep people safe.

- Worker protection: Labor laws ensure fair wages, safe working conditions, and limits on child labor.

- Environmental rules: Governments set emission standards, regulate pollution, and encourage clean energy use.

Example: Antitrust laws in the United States prevent companies from forming monopolies that crush competition. By breaking up or regulating large corporations, governments keep markets open and fair.

On the other hand, deregulation reduces government rules to allow more competition. Sometimes, fewer rules can spark innovation and lower costs. For instance, deregulation of airlines in the U.S. in the late 1970s increased competition and made air travel more affordable. But too much deregulation can also lead to instability, like the financial crisis of 2008, which was partly caused by weak oversight of banks.

The key is balance: enough regulation to protect the public, but not so much that it strangles innovation or efficiency.

4. Trade Policy

Markets aren’t just domestic — they are global. Governments influence markets through trade policy, which decides how goods and services move across borders.

- Tariffs: Taxes on imported goods. Tariffs protect domestic industries by making foreign products more expensive. However, they can also raise prices for consumers.

- Quotas: Limits on how much of a product can be imported. Quotas protect local producers but reduce variety in the market.

- Free trade agreements: Deals between countries that remove tariffs and quotas to encourage cross-border trade. These agreements often lower prices for consumers but can expose local industries to more competition.

Example: U.S. tariffs on steel and aluminum in recent years aimed to protect American manufacturers. But they also raised costs for industries that use steel, such as construction and car-making, showing how trade policies can ripple through the entire economy.

Trade policy shapes entire industries. A supportive policy can help local companies grow and compete globally, while restrictive policies can shield jobs but sometimes hurt consumers with higher prices.

5. Subsidies and Incentives

Another way governments shape markets is by offering subsidies and incentives. These are financial supports or tax benefits designed to encourage certain behaviors or industries.

- Subsidies: Direct payments or price supports to keep industries alive or competitive. For example, many governments provide subsidies to farmers to ensure a steady food supply, even when market prices fall.

- Tax incentives: Reductions or credits designed to steer investment into targeted areas. For instance, tax credits for installing solar panels encourage households to adopt renewable energy.

- Industry support: In times of crisis, governments often provide bailouts or financial aid to industries that are considered too important to fail, such as airlines, banks, or auto companies.

Example: In recent years, many countries have offered subsidies and tax breaks for electric vehicles (EVs). These incentives helped push carmakers and consumers toward greener options, speeding up the shift away from gasoline-powered cars.

While subsidies can promote innovation and protect vital industries, they can also distort markets if used excessively. For instance, if one industry receives constant government support, it might become less competitive and dependent on aid.

6. Government as a Market Participant

Governments are not just rule-makers; they also take part in markets directly. Their purchases, investments, and ownership have major effects on supply and demand.

- Public spending: Governments buy goods and services every day, from building highways and bridges to purchasing medical supplies and military equipment. This creates jobs and injects money into industries.

- Public contracts: By awarding contracts to private firms, governments can support entire sectors like construction, technology, or healthcare.

- Ownership: In some countries, governments own key industries such as oil, electricity, or railroads. In these cases, the government itself is a market player, shaping prices and availability.

Example: During the Great Depression, U.S. government programs invested heavily in infrastructure projects like dams, roads, and schools. These projects not only created jobs but also laid the foundation for long-term economic growth. More recently, government contracts for vaccines during the COVID-19 pandemic spurred rapid development and distribution.

As a market participant, the government can stimulate demand in hard times, guide resources to essential areas, or provide services the private sector might ignore.

Case Studies: Real-World Examples of Government Influence on Markets

1. Stimulus Checks During COVID-19 (United States)

In 2020 and 2021, the U.S. government issued several rounds of stimulus checks to households during the pandemic. This was a direct form of fiscal policy—putting cash into people’s hands so they could continue buying essentials, paying rent, and supporting local businesses. While this boosted demand and softened the economic blow, it also contributed to higher inflation later, showing both the benefits and risks of such policies.

2. Steel Tariffs and Ripple Effects

When the U.S. government imposed tariffs on imported steel and aluminum, the goal was to protect domestic steelmakers from foreign competition. While this did help U.S. producers, it also made steel more expensive for industries like construction and car manufacturing. Consumers eventually paid higher prices for finished products. This case shows how trade policy often creates winners in one sector and losers in another.

3. Environmental Rules on Car Makers

Governments worldwide have pushed car makers to reduce emissions and improve fuel efficiency. For example, the European Union has strict carbon emission targets for vehicles. These rules forced automakers to invest heavily in electric vehicles (EVs) and cleaner technologies. While the transition was costly for companies, it also spurred innovation and opened new markets for EVs.

4. Agriculture Subsidies

In many countries, farming is heavily supported by subsidies. For instance, U.S. farmers receive payments to grow certain crops like corn, wheat, and soybeans. These subsidies keep food prices more stable and protect farmers from unpredictable markets. However, critics argue that they can lead to overproduction and distort global trade, since farmers in other countries without subsidies may struggle to compete.

5. Vaccine Development and Distribution

During the COVID-19 pandemic, governments around the world invested billions into vaccine research and production. In the U.S., programs like Operation Warp Speed provided funding and guaranteed contracts to pharmaceutical companies. This partnership between public money and private industry sped up vaccine availability, showing how direct government participation in markets can save lives and stabilize economies.

These examples highlight how government actions—whether through spending, trade rules, regulation, or subsidies—shape markets in real and sometimes unexpected ways. The results can be positive, like fostering innovation, or negative, like raising consumer prices. Either way, the influence is powerful and unavoidable.

Benefits and Risks of Government Influence

Government involvement in markets can bring stability and fairness, but it also carries risks if taken too far. Understanding both sides helps explain why debates over regulation, spending, and trade are so common.

Benefits

- Stability in Tough Times

During recessions or crises, governments can step in with stimulus spending, tax relief, or central bank action to keep economies from collapsing. Without this support, downturns would be longer and more painful. - Protection for Consumers and Workers

Rules on product safety, workplace conditions, and financial practices prevent abuse and protect ordinary people. For example, food safety laws keep harmful products off grocery shelves. - Fair Competition

Antitrust laws stop monopolies from crushing smaller businesses. By ensuring fair play, governments help markets remain open and innovative. - Encouraging Growth and Innovation

Through subsidies, grants, and tax incentives, governments can push industries toward long-term goals, such as renewable energy or advanced technology, that might otherwise grow too slowly.

Risks

- Overregulation

Too many rules can make it costly for businesses to operate, discourage innovation, or drive industries to move abroad. - Market Distortions

Subsidies and tariffs can create artificial winners and losers. While one sector may benefit, others may suffer from higher costs or limited competition. - Political Influence

Government decisions are not always made for economic reasons. Sometimes policies are designed to win votes or favor certain groups, even if they hurt the wider economy. - Debt and Inflation

Heavy government spending, especially if funded by borrowing, can lead to rising debt and inflation. While spending may bring short-term relief, it can create long-term financial problems.

In short, government influence is a balancing act. Done well, it creates stable, fair, and innovative markets. Done poorly, it can slow growth, raise costs, or tilt markets in unfair ways.

FAQs

Q1. Why do governments regulate markets?

Governments regulate markets to protect consumers, workers, and the environment. Rules ensure products are safe, competition is fair, and businesses don’t harm society in the pursuit of profit.

Q2. Do free markets exist without government involvement?

Not really. Even the freest markets have some government role, such as protecting property rights, enforcing contracts, and preventing fraud. Without this, markets would struggle to function.

Q3. How do taxes influence consumer spending?

Higher taxes reduce the money people have to spend, which can cool demand. Lower taxes increase disposable income, which encourages more spending and investment.

Q4. What happens if governments interfere too much?

Too much interference can slow innovation, raise costs, and discourage competition. Over time, it can make economies less dynamic and less efficient.

Q5. What is the difference between fiscal policy and monetary policy?

Fiscal policy involves government spending and taxation, while monetary policy involves controlling the money supply and interest rates—usually handled by central banks. Both are used to guide the economy.

Conclusion

Governments influence markets in many ways—through taxes, spending, regulations, subsidies, trade policies, and even direct participation. These actions shape the choices businesses make, the prices consumers pay, and the jobs available in the economy.

When done wisely, government influence keeps markets stable, fair, and forward-looking. It protects people from abuse, encourages innovation, and helps economies recover from downturns. But when overused or mismanaged, it can create distortions, raise costs, and limit growth.

The truth lies in balance. Markets thrive when businesses and consumers are free to act, but with guardrails that protect the public good. Governments don’t replace markets; they guide them—sometimes gently, sometimes forcefully—to serve broader goals like stability, fairness, and long-term prosperity.

Understanding how governments shape markets helps us see that every price tag, every job opportunity, and every investment decision is influenced not just by supply and demand, but also by public policy. Markets and governments are deeply linked, and their relationship defines the economy we live in every day.