In the United States right now, investing in stocks, starting a side hustle, or even starting a business that earns you an extra $1000 is no more a ‘nice to have’ because the cost of living is increasing steadily, and things you will easily afford before are no longer as simple to get anymore.

To put it in a better perspective, the top 10% of Americans today hold approximately 90% of all stocks. So, if you’ve been wondering whether investing in stocks will yield fruits, you just nneed to study how the millionaires became rich – they all bought some stock at some point.

In this post, we will share helpful tips and strategies that will teach you how to enter into the stock market as a newbie, and also show you how much you really need to invest in stocks at the moment, in order to earn $1000 a month.

Table of Contents

Key takeaways

- You’ll need a portfolio worth at least $300,000 which generates a minimum of 4% dividends in order to earn $1000 per month.

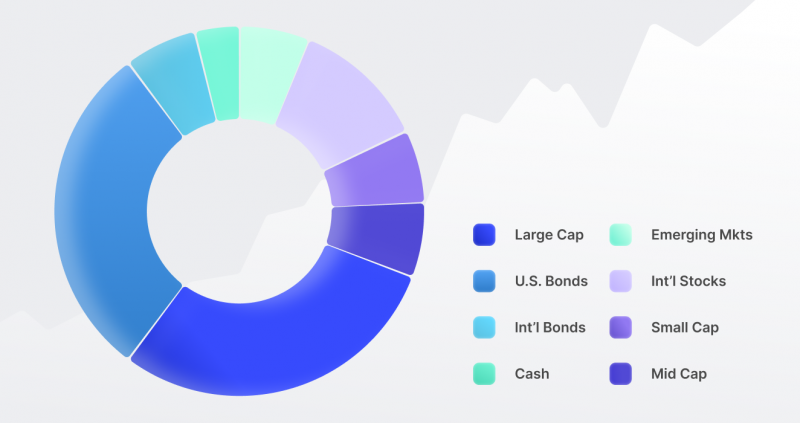

- You will also need to diversify your portfolio by investing in about 20 to 30 companies in different sectors (like energy, transportation, A.I., housing, and medicine) to help protect your income.

- If you do not want to get tangled in all the speculations and chart readings, you can also choose an investment company with a good track record for delivering dividends to their investors.

What is a Dividend?

Dividends are a portion of a successful company’s profits which are distributed to their investors, and these dividends are normally distributed every three months.

However, it is important to note that not every company pays dividends due to their size, profit margins, or growth needs. Smaller companies or startups will usually prefer to invest the money back into the business to grow it.

Dividend payments normally come from more established companies like Apple, Amazon, AT&T, Coca-Cola, and Meta, which generate cool profits year after year.

There are three main types of dividend investing and we will explain them in detail below:

1. Dividend Growth

This is the most reliable form of stock investing because it focuses on buying the stock or putting your money into companies who have consistently increased their dividends over decades.

These faithful companies have proven that they can stand the test of time and will be here for the foreseeable future. Examples are Apple, Johnson & johnson, and Proctor and Gamble Company.

2. Finding Hidden Gems

This strategy focuses on doing extensive research to find those solid companies who are temporarily out of favor in the market at the moment. In short, this is Warren Buffet’s favored investment approach.

Even though this strategy involves hours or days, or even months of research, it could lead to high current yields (ie the dividend paid divided by the price) and a rise in the stock when the market starts to recognize the true value of the company.

3. Dividends for Current Income

This startegy focuses on companies that have very high dividend yields at the moment. It’s a type of investing that targets companies that are currently doing well and their dividends payment are high.

It is also important to do some research to ensure that those yields are sustainable.

How to make $1000 a month in Dividend Income

The journey to consistently making $1000 every month begins with understanding the math. The median dividend yield for dividend aristocrats in the first quarter of 2025 was around 2.25%, while the average yield for the S&P 500 companies in 2024 hit an all time low of about 1.3%.

For this reason, making $1000 consistently each month has become harder without a significant investment capital upfront.

Let’s give an example to put things in a clearer perspective.

For instance, if you do your research diligently and find companies that have shown consistency in paying out higher dividends, you should also bear it in mind that higher yields are riskier to keep up with.

A few of these companies would include Verizon Communications (VZ), Dow Chemical (DOW), Ares Capital Corporation (ARCC), or NNN REIT (NNN), which is a real estate investment trust.

With these current numbers and math, in order for you to earn $1000 monthly, you will need to invest in stocks that have an average dividend yield of 4%, and you will have to pump in about $300,000 to generate $12,000 annually ($1,000 monthly).

Howevr, if you manage to find companies that pay a 6% yield, you could be closer to that goal with a $200,000 investment instad.

Building Your Dividend Portfolio to Earn $1000 Monthly

There are two major ways of building a portfolio that pays you $1000 monthly dividends consistently.

If you decide to pick individual stocks alone, you must spread your investments across 20 to 30 different companies in different sectors. This diversification of your investment portfolio safeguards your income if a few companies or sectors are not doing well at any point in time.

For instance, if the financial sector isn’t producing profits, your companies in the agriculture sector will produce profits and balance out the portfolio. You should never put all your money into one company or sector in the economy. It is bad investment ethics to do so.

Secondly, if you are the hands-off type of investor, you should consider investing in a high-yield dividend exchange traded fund (ETF) like the Nasdaq-100 High Income ETF (IQQQ), which has a high current annual dividend yield of 9.29%.

With this particular ETF, you’d only need to invest about $107,000 to generate $1,000 evry month. Also, your fund managers will do the work for you by finding high-dividend companies among the larger firms in the U.S.

You should also bear in mind that the Nasdaq 100 is very dependent on tech stocks, which are notoriously volatile.

In the table below, we compare investing in a few high-yield dividend stocks with a broader spread of dividend stocks and ETFs.

Comparing Dividend Investments

| Strategy Feature | High to Yield Stocks (6% to 12% yields) | Diversified Stocks (3% to 5% yields) | High to Yield ETF (8% to 12% yields) |

|---|---|---|---|

| Investment Needed for $1,000/month | $100,000 to $200,000 | $250,000 to $400,000 | $100,000 to $150,000 |

| Risk Level | Higher risk of dividend cuts | Lower risk through diversification | Moderate risk to built to in diversification but higher yields |

| Portfolio Size | 5 to 10 high to yield stocks | 20 to 30 stocks across sectors | Single ETF |

| Income Stability | More volatile | More stable, consistent growth | Moderately stable since the ETF manages holdings |

| Growth Potential | Limited price appreciation | Better balance of income and growth | Moderate: Depends on ETF focus |

| Management Required | High: frequent monitoring | Moderate to quarterly review | Low: ETF handles management |

| Best For | Experienced investors comfortable with risk | Long to term investors seeking steady income | Investors wanting simplified high to yield approach |

Final Thoughts

It is very possible to earn $1000 monthly from dividend payments if you employ the right strategy. Even though the required investment capital for such returns is relatively large, you do not need to wait until you have hundreds of thousands of dollars before investing.

You can and you should begin with what you can afford, and gradually build your portfolio up to your goal through regular contributions and reinvesting your dividends.

Research Help

Which companies can I invest in to earn $1000 monthly?

Here are a few companies we found that pay monthly dividends to investors:

- Realty Income (O): This is a real estate investment trust (REIT) that owns more than 15,000 commercial properties in high value areas.

- Main Street Capital (MAIN): MAIN is a business development company (BDC) that provides financial help and loans to small and mid-sized companies. They have consistently paid a monthly dividend since its IPO in 2007 (that’s close to 20 years of faithfulness), and they are loved by many for their dividend safety.

- STAG Industrial (STAG): STAG is another real estate investment trust (REIT) that owns more than 10,000 industrial real estate properties, like warehouses and distribution centers. One advantage they have is that they have consistently increased dividends payments year after year since going public.

- Agree Realty (ADC): ADC is a retail real estate investment trust (REIT) that invests in properties that are rented to business owners across different industries. They have also never failed to pay dividends to their investors since going public.

- Apple Hospitality REIT (APLE): APLE is a hospitality real estate investment trust (REIT) that owns more than 15,000 luxurious hotel buildings.

Disclaimer: This is not financial advice. All investments have risks, and there is no guarantee of returns. You should perform your own research and consult a financial professional before investing