Growing up as a child, I always wondered what credit scores were because they were always mentioned in a few discussions by our parents and teachers. But what is a credit score really? It’s that little number that seems to decide if you get the car, the house, or even the shiny new credit card you want.

Your credit score is like a financial report card. Instead of A’s and B’s, you get a three-digit number that lenders peek at to decide whether to trust you with money. The higher the score, the more doors open — cheaper loans, better apartments, even easier job approvals in some cases. The lower it is, the harder life feels.

Here’s the good news: you don’t need to be a money genius to fix it. Even if your score looks more like an “F” than an “A+,” there are steps you can take today to raise it fast. And don’t worry — I’ll keep this so simple a 10-year-old could understand and implement it. Because honestly, if we adults had learned this stuff in 5th grade, half of us wouldn’t be in money trouble now.

Table of Contents

What Is a Credit Score and Why Should You Care?

Think of a credit score like a grade for your money behavior. It usually falls between 300 and 850.

Here’s how the main version (FICO) is scored:

- 35% Payment History – Do you pay bills on time?

- 30% Credit Utilization – Do you borrow too much compared to your limits?

- 15% Length of Credit History – How long have you been borrowing?

- 10% Credit Mix – Do you handle different kinds of debt (credit cards, car loans, etc.)?

- 10% New Credit – Have you applied for a bunch of new accounts recently?

If you want to dive into the official breakdown, check FICO Score Factors here.

Why does this matter? Because your score affects how much interest you pay on loans, whether a landlord rents to you, and sometimes even whether you get hired. In short: it matters more than we’d like to admit.

Step One: Check Your Score and Report

Would you take a test without looking at the questions first? Nope. Same with credit. The first thing you must do is check your credit score and your full report.

- You can get a free credit report from all three major bureaus (Experian, Equifax, TransUnion) at AnnualCreditReport.com.

- You can also check free scores at places like Credit Karma or directly through your bank or credit card app.

When you read your report, look carefully for:

- Mistakes (wrong balance, an account you never opened).

- Old debts that should have disappeared.

- Duplicate accounts (yes, it happens).

Pro tip: Errors are more common than you’d think, and fixing them can raise your score quickly.

Step Two: Pay Bills on Time (The Golden Rule)

If there’s one golden rule of credit, it’s this: always pay on time. Payment history makes up the biggest slice (35%) of your score. Even one missed payment can knock points off for months.

Here’s how to avoid that nightmare:

- Set up autopay for at least the minimum payment.

- Use phone reminders or calendar alerts.

- If you’re already late, call your lender. Sometimes they’ll remove the late mark if you’ve been good otherwise.

Quick story: A friend of mine forgot one $50 card bill. His score dropped nearly 70 points. He called the bank, explained it was an accident, and they actually removed it. Boom—score back up.

Learn more from the Consumer Financial Protection Bureau about what late payments do and how to avoid them.

Step Three: Pay Down Credit Card Balances (Tame the Monster)

Here’s a fancy term that’s actually simple: credit utilization. This is the percentage of your card limit you’re using. Example: if your limit is $2,000 and you owe $1,000, your utilization is 50%. Lenders like to see this below 30%, and under 10% is even better.

Ways to lower utilization fast:

- Pay more than once a month (so your reported balance looks lower).

- Use the debt snowball (pay off small balances first) or debt avalanche (attack high interest first).

- Move a balance to a lower-interest card (but only if it helps).

Example: John had a $2,000 limit and owed $1,800 (90% utilization). He paid it down to $600 (30%). In the next month’s report, his score jumped by 40 points.

Step Four: Don’t Close Old Accounts (Let Them Age Gracefully)

This one feels backwards. You’d think closing an old, unused card would help, right? Nope. It hurts. Why? Because age of accounts makes up 15% of your score. Closing accounts shortens your average history.

Instead:

- Keep old cards open.

- Use them once or twice a year for a small purchase (like gas or Netflix) and pay it off.

Think of your oldest card as that quiet friend who doesn’t say much but keeps your group together. Don’t ditch them.

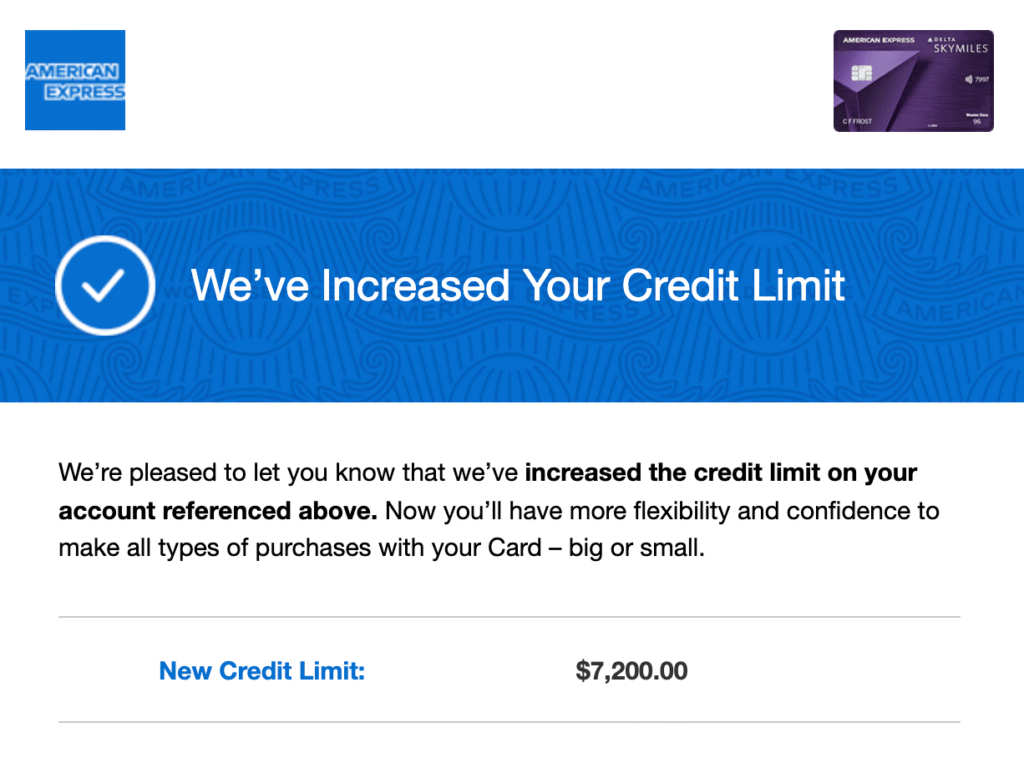

Step Five: Ask for a Credit Limit Increase (Without Spending More)

Here’s a sneaky trick: you can lower your utilization rate without paying off debt—by increasing your credit limit.

- Most banks let you request this online or through the app.

- Do it when your income has gone up or your payment history looks strong.

- Don’t do it if you’ve had late payments recently—they might say no.

Example: Mary had a $1,000 card with a $900 balance (yikes, 90% utilization). She requested a limit increase to $2,500. Now her utilization dropped to 36% without paying anything, and her score jumped the next month.

Learn how at Experian – Credit Limit Increase.

Step Six: Become an Authorized User (Borrow Someone Else’s Good Behavior)

This one is like getting a “credit piggyback ride.” If a family member or friend with great credit adds you as an authorized user on their card, you inherit their history for that card.

- You don’t even need to use the card.

- Their good history helps you.

- Their bad habits hurt you—so only do this with someone reliable.

This is especially great for teens or people just starting out.

Step Seven: Fix Errors on Your Report (Clean Up the Mess)

Did you know nearly 1 in 5 people has an error on their credit report? That’s millions of folks losing points for something that isn’t even their fault.

Here’s how to fix it:

- Highlight the mistake (say, an account that isn’t yours).

- File a dispute online with each bureau: Equifax, Experian, TransUnion.

- They have 30 days to investigate.

Sometimes just fixing one error can add dozens of points.

Official guide: FTC – Disputing Errors.

Step Eight: Mix Up Your Credit (Show Variety)

Lenders like variety. If all you have is one credit card, they can’t see how you handle other debt. That’s where credit mix comes in.

Options:

- A small personal loan.

- A credit-builder loan (super easy and safe).

- A store card (but use responsibly).

A great option: Self Credit Builder Loan.

Think of it like school: teachers want to see you do well in math, reading, and science—not just one subject.

Step Nine: Don’t Apply for Too Much New Credit (Slow and Steady)

Every time you apply for new credit, the lender does a hard inquiry. It’s like the teacher marking your paper with red pen. Too many at once looks desperate.

Best practice:

- Space out applications at least 6 months.

- Only apply when you really need it.

How Fast Can You Really Improve a Credit Score?

This is the big question. The truth? It depends on your situation.

- Fast fixes (weeks): paying down balances, disputing errors, becoming an authorized user.

- Medium (2–6 months): paying on time consistently, raising limits.

- Long-term (6–12+ months): building credit age, mixing types of accounts.

Example: Someone with a 580 score can realistically get into the 680–700 range within 12 months with steady effort.

Common Myths That Keep People Stuck

- Myth: Carrying a balance helps your score.

Truth: It hurts—you pay interest for nothing. - Myth: Checking your own score lowers it.

Truth: Nope. Soft checks don’t matter. - Myth: Closing old accounts helps.

Truth: It usually hurts.

Storytime: The Credit Comeback

Let me tell you about Sarah. She had a 560 score after missing payments on two cards. She thought she was doomed. Instead, she:

- Paid off one card completely.

- Set autopay for all bills.

- Became an authorized user on her mom’s card.

- Disputed a mistake on her report.

Within 6 months? Her score hit 670. Not perfect, but enough to get a car loan at a fair rate.

Tips to Stay on Track Long-Term

- Pay every bill on time, even if it’s the minimum.

- Keep balances low.

- Check your report yearly.

- Don’t over-apply for credit.

Conclusion – Your Score Is Like a Plant

Here’s the truth: there’s no instant magic trick. But with steady care, your credit score will grow—like watering a plant. Miss payments, max cards, or close accounts too soon, and it wilts. Nurture it with good habits, and one day you’ll look back and smile at how far you’ve come.

FAQs

What is a good credit score?

Above 700 is considered good. 760+ is excellent.

Can I raise my score 100 points fast?

Yes, sometimes—especially if you pay down high balances or fix errors.

Do medical bills hurt my score?

They can if they go to collections, but new rules are making them less damaging.

Can I still get a loan with bad credit?

Yes, but you’ll pay higher interest. Best to improve your score first.

What’s the fastest fix before buying a house?

Pay down cards below 30% utilization and dispute any errors right away.