If you’ve been using Mint for years to track your finances, you may be searching for a new solution now that the platform is being phased out. This guide will show you exactly how to migrate your Mint data to Monarch Money, including step-by-step instructions, account setup, pricing breakdowns, and time-saving shortcuts to ensure a smooth transition.

Table of Contents

Why Move from Mint to Monarch Money?

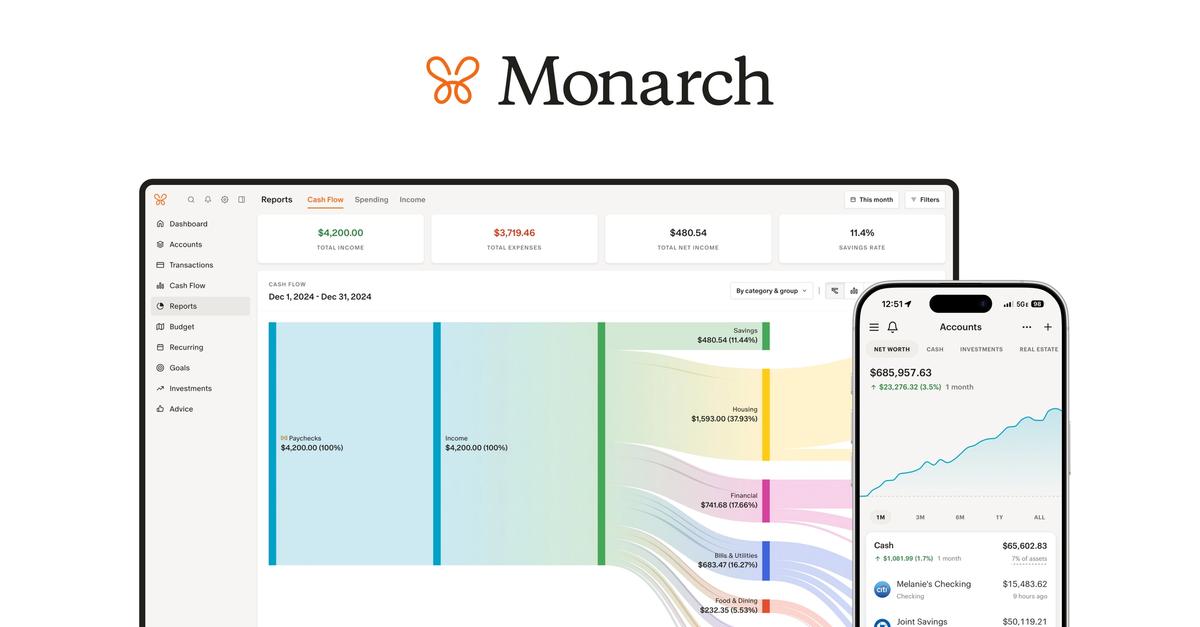

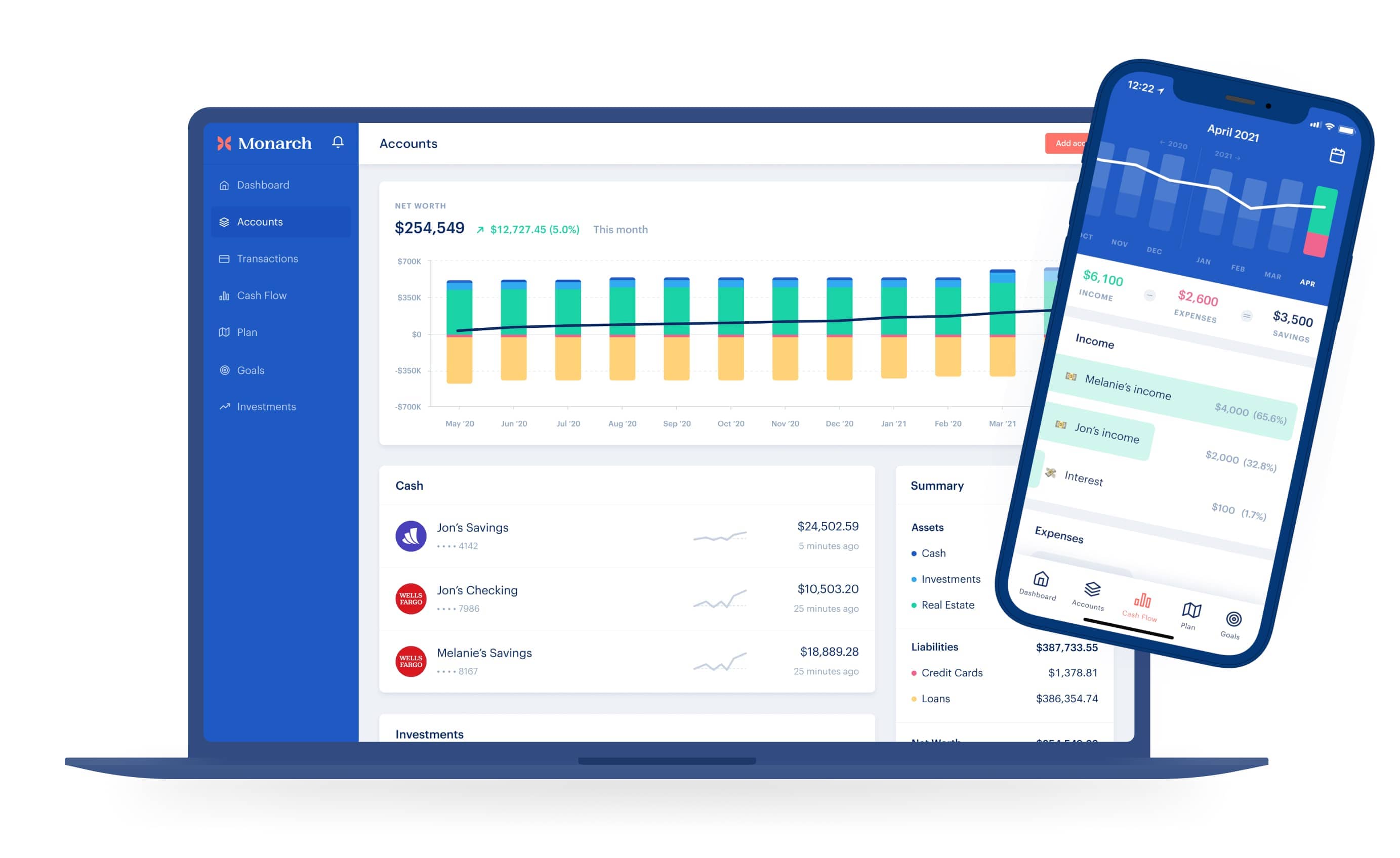

Mint, once a pioneer in personal financial management, is officially shutting down in 2024 (CNBC reports Mint’s closure). With its departure, users need to find a sustainable budgeting and financial tracking solution. Monarch Money has quickly risen as one of the best alternatives, offering modern features like collaborative budgets, investment tracking, goal setting, and a sleek mobile interface.

Key Advantages of Monarch Money

- Unlimited accounts and transactions synced automatically

- Collaborative household budgets for spouses or partners

- Detailed investments and net worth tracking with live updates

- Data import options from Mint for faster onboarding

- Bank-level security compliant with SEC standards

Step 1: Export Your Data from Mint

Before switching, you’ll need to extract your existing data from Mint. This includes transaction history, account balances, and budget categories.

- Log in to Mint.com using your account credentials.

- Go to Transactions and scroll to the bottom of the page.

- Click the Export button to download your data as a

.CSVfile. - Save the file securely on your desktop or in a backup folder. This file contains sensitive financial details, so keep it encrypted or use secure cloud storage.

Step 2: Create a Monarch Money Account

Now that you have your Mint export, you need to sign up for Monarch. Monarch’s pricing as of 2024 is as follows:

| Monarch Money Plan | Cost | Key Features |

|---|---|---|

| Free Trial | 30 Days Free | Includes all premium features for one month |

| Annual Subscription | $99.99/year | Unlimited accounts, budget tracking, collaborative features |

| Monthly Subscription | $14.99/month | Flexibility to cancel anytime, access to premium features |

Action Step: Visit Monarch Money’s official website, click on “Start Free Trial,” and register using your email or Google account.

Step 3: Import Your Mint Data into Monarch

This is where Monarch really stands out. While some Mint alternatives require you to start fresh, Monarch has developed an import feature for Mint users.

- Log into Monarch.

- Navigate to Settings > Import Data.

- Select the file type: Mint Export (.CSV).

- Upload your saved Mint file.

- Map categories and accounts if Monarch prompts you to reconcile mismatches.

- Click Finalize Import. Your historical transactions and categories will populate automatically.

Pro Tip: If your Mint export contains closed accounts or duplicate transactions, use Monarch’s transaction filter tools to clean up and archive old records for better reporting accuracy.

Step 4: Sync Accounts and Automate Updates

After importing your historical data, connect your live bank, credit card, and investment accounts to Monarch so that new transactions automatically update.

How to Connect Accounts

- Go to Accounts in Monarch’s sidebar.

- Select Add Account and search for your bank or financial institution.

- Authenticate using your online banking credentials via Monarch’s secure partner, Plaid.

- Repeat for all financial institutions you want to include.

How Monarch Money Compares with Mint

The table below highlights some of the key differences between Mint and Monarch:

| Feature | Mint | Monarch Money |

|---|---|---|

| Availability | Shutting down in 2024 | Fully active and expanding features |

| Budgeting Tools | Basic categorization | Custom goals, shared budgets, real-time collaboration |

| Investment Tracking | Minimal details | Comprehensive dashboards and portfolio analysis |

| Subscription Cost | Free | $14.99/month or $99/year |

| Data Import | Export-only | Full Mint import option |

Tips for a Smooth Migration

- Clean up categories: Standardize inconsistent labels carried over from Mint.

- Archive old accounts: Closed accounts can be preserved without cluttering active dashboards.

- Set new goals: Use Monarch’s milestone feature for emergency funds, loan repayment, or savings targets.

- Invite your partner: Household collaboration is one of Monarch’s standout tools.

Security and Privacy Considerations

Financial data security is paramount. Monarch uses bank-level encryption and Plaid for secure account connections. Unlike Mint, which relied heavily on advertising, Monarch is subscription-based, meaning your data isn’t monetized for marketing. The U.S. Federal Trade Commission (FTC) recommends consumers prioritize platforms with strong encryption and transparent business models—Monarch fits this model effectively.

FAQs About Migrating from Mint to Monarch Money

1. How long does it take to migrate Mint data to Monarch?

Most users complete the export, import, and setup process in under 30 minutes.

2. Is there a cost to import Mint data?

No, importing data is free with Monarch during your trial and subscription period.

3. Do I need to re-categorize transactions after migration?

Some categories may not map perfectly. Spend 15–20 minutes cleaning categories for accuracy.

4. Can I use Monarch Money for joint accounts with my spouse?

Yes, Monarch is built for collaboration, unlike Mint, which was single-user focused.

5. What happens to my Mint account after shutdown?

Mint accounts will no longer sync or be available after the closure date. Export your data before losing access.

6. Does Monarch Money work outside the U.S.?

Currently, Monarch primarily supports U.S. and Canadian institutions. Support is expanding internationally over time.

7. What if the Mint file won’t upload?

Ensure the file format is .CSV. If issues persist, Monarch’s support team can convert your export.

8. Does Monarch track crypto or alternative investments?

Yes, you can manually add crypto holdings, real estate, or alternative assets for net worth tracking.

9. Will Monarch cost more than Mint?

Yes, but Monarch’s subscription eliminates ads and provides premium features with stronger data privacy.

10. Can I cancel my Monarch subscription anytime?

Yes, you can cancel during the trial or monthly plan without penalty. The annual plan is billed upfront.

Conclusion

Transitioning from Mint doesn’t have to be disruptive. With careful exporting, a straightforward Monarch import process, and robust budgeting tools, Monarch Money is a reliable, feature-rich replacement for Mint users. By learning how to migrate Mint data to Monarch, you preserve your financial history while embracing a platform built for modern money management. Start your Monarch free trial today and keep your financial journey on track without losing momentum.