- Overview of the Exness Investment Calculator

- Selecting the Right Account Type and Trading Instruments at Exness

- Maximizing Trading Efficiency with the Exness Investment Calculator

- Utilizing the Exness Investment Calculator for Effective Trading Planning

- Frequently Asked Questions About the Exness Investment Calculator

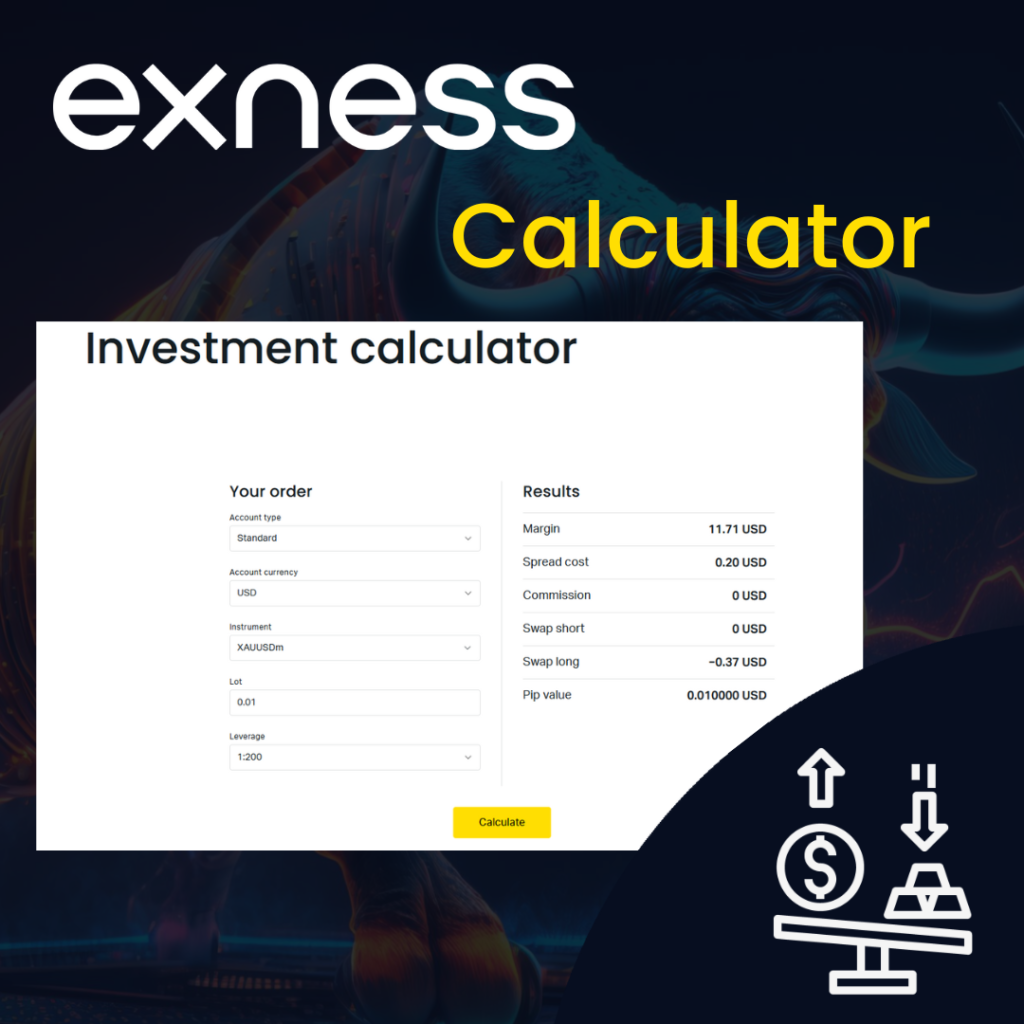

The Exness Investment Calculator is a multifunctional tool featured on the Exness platform. It is crafted to help traders evaluate potential returns and manage risks effectively. This powerful tool consolidates the functionalities of various calculators—profit, forex, leverage, and more—into a single user-friendly interface, enabling traders to assess different trading scenarios and forecast outcomes before making actual transactions.

Overview of the Exness Investment Calculator

The Exness Investment Calculator is designed to facilitate traders in calculating expected returns and refining their trading strategies. It plays a pivotal role in strategizing asset allocation, risk management, and transaction efficiency on the Exness platform.

Key Features of the Investment Calculator:

- Profit Calculator: This feature helps estimate potential profits or losses by accounting for variables such as entry and exit prices, trade sizes, and currency pairs.

- Usage: Input buy and sell prices along with the trade amount to compute potential outcomes, factoring in spreads and fees.

- Forex Calculator: Essential for forex traders, this calculator aids in performing currency conversions and calculating margin requirements.

- Usage: Enter information such as currency pair, trade size, and leverage to receive crucial financial metrics like required margin and pip value.

- Leverage Calculator: Determines the influence of leverage on trades, which can significantly alter both potential profits and associated risks.

- Usage: Provide the capital amount, leverage ratio, and position size to calculate total exposure and required margin.

- Trading Calculator: Integrates features of profit, forex, and leverage calculators, offering a holistic financial analysis for upcoming trades.

- Usage: Input details such as instrument type, price levels, lot size, and leverage to obtain comprehensive data on margins, pip values, swap fees, and possible financial results.

Benefits:

- Risk Management: Facilitates precise risk calculations for each trade, assisting traders in maintaining exposure within safe limits.

- Strategy Planning: Supports detailed planning of trade parameters, including entry and exit points, expected returns, and stop-loss orders.

- Financial Optimization: Enhances effective leverage use, balancing the potential for high returns against the risks involved.

- Accessing the Tool: The Exness Investment Calculator is accessible through the tools or resources section on the Exness website. Log into your account to utilize this feature, ensuring that calculations are specifically tailored to your trading conditions and account settings.

- Using the Exness Investment Calculator: This essential tool allows traders to thoroughly analyze potential trades and refine their strategies. Follow a step-by-step approach to navigate its various functions and fully leverage its capabilities for optimal use.

The Exness Investment Calculator is invaluable for both seasoned traders and newcomers, providing detailed insights crucial for effective portfolio management. While it offers important financial metrics, combining these insights with personal research and strategy adjustments is recommended for well-rounded trading decisions.

Selecting the Right Account Type and Trading Instruments at Exness

Account Type Selection:

- Process: Begin by selecting an appropriate Exness trading account, such as Standard, Pro, or ECN. Each account type offers unique trading conditions, including varying spreads, leverage options, and commission rates.

- Impact: The choice of account type directly influences your trading strategy’s effectiveness and risk exposure. It determines transaction costs, the financial leverage available, and the overall trading environment, thereby affecting profitability and risk levels.

Trading Instrument Selection:

- Process: Choose the financial instrument you wish to trade. Exness offers a variety of instruments, including forex pairs, commodities, indices, and cryptocurrencies.

- Impact: Different instruments exhibit varying levels of volatility and liquidity, impacting trade execution and potential profitability. Your choice should align with your market analysis, trading style, and risk tolerance.

Understanding Account Features

- Process: Review the specific features associated with each account type. This includes looking at the details like minimum deposit requirements, the availability of swap-free options for Islamic accounts, and the type of execution (instant or market).

- Impact: The features of the account determine the operational flexibility you have and the cost-effectiveness of your trading operations. For instance, accounts with lower minimum deposits might be ideal for novice traders, while those with market execution and tighter spreads are better suited for advanced traders focusing on scalping or algorithmic trading.

Consideration of Financial Goals

- Process: Align your financial goals with the account type. Whether you’re aiming for long-term growth through diverse portfolio investments or rapid gains from day trading, Exness provides specific account types tailored to different strategic goals.

- Impact: Choosing an account that fits your financial objectives helps in maximizing efficiency and effectiveness in trading operations, ensuring that your trading approach and financial goals are in sync.

Risk Management Compatibility

- Process: Assess each account type’s compatibility with your risk management strategies. This includes considering the leverage limits and margin requirements that can significantly affect your exposure to risk.

- Impact: Effective risk management is crucial for sustainable trading. Selecting an account that offers appropriate leverage and risk control features can help mitigate potential losses and enhance the security of your investments.

Liquidity and Trading Hours

- Process: For traders interested in specific markets like forex, commodities, or indices, it’s important to understand the trading hours and liquidity of these instruments as provided by Exness.

- Impact: Instruments with higher liquidity often provide tighter spreads and more stable pricing, which can affect trading costs and execution speeds. Knowing the trading hours helps in planning when to enter and exit trades, especially for strategies dependent on market timing.

Compatibility with Trading Platforms

- Process: Ensure the selected account type is compatible with the trading platforms you intend to use, such as MetaTrader 4 or MetaTrader 5, which are commonly offered by Exness.

- Impact: Some account types might offer additional features or optimized performance on specific platforms, enhancing trading efficiency and the overall user experience.

Future Scalability

- Process: Consider whether the account type will support your trading as it evolves. This means checking if the account can accommodate growing investment sizes or diversifying trading strategies.

- Impact: An account that can scale according to your evolving trading needs prevents the hassle of switching account types frequently, providing continuity and stability in your trading journey.

By carefully considering these extended factors in the selection process, traders can ensure they choose the right Exness account type and trading instruments that best fit their trading style, strategy, and financial ambitions, leading to a more tailored and effective trading experience.

Setting Up Trade Parameters: Position Size, Entry Price, and Leverage

1. Position Size:

- Process: Determine the size of your position, typically measured in lots or units, depending on the instrument. This factor plays a critical role in the calculation of potential returns and risk management.

- Impact: The position size significantly influences the risk and potential reward of your trades. Larger positions increase both the potential profit and the risk of significant losses, emphasizing the need for meticulous risk management.

2. Entry Price:

- Process: Input the price at which you intend to enter the market, based on thorough market analysis and your specific trading strategy.

- Impact: The entry price sets the initial cost basis of your trade, which is crucial for determining potential gains or losses and for setting effective stop-loss and take-profit levels.

3. Leverage:

- Process: Select the degree of leverage you wish to apply to your trade. Leverage allows you to control larger positions than your existing capital would normally permit.

- Impact: While leveraging can enhance potential returns, it also increases the financial risk of trading. It’s essential to choose a leverage level that matches your risk appetite and trading strategy.

Choosing the Correct Account Currency

- Process: Ensure that the currency of your trading account is correctly set. This choice should reflect the primary currency you use for trading to ensure the accuracy of all financial calculations on the platform.

- Impact: The correct account currency is vital for precise computation of profits, losses, and margin requirements. It affects how currency exchange rates will impact your trading results, particularly if you are trading instruments in different currencies.

By thoughtfully choosing your account type, trading instruments, and setting appropriate trade parameters, you can optimize your trading strategy to better manage risks and capitalize on opportunities in the markets.

Maximizing Trading Efficiency with the Exness Investment Calculator

The Exness Investment Calculator is an indispensable tool for traders, designed to facilitate detailed trade planning and risk management. By entering critical trade parameters like account type, trading instrument, position size, entry price, leverage, and account currency, traders can gain a comprehensive view of potential trade outcomes. This helps in optimizing strategies for maximum profitability and effective risk control.

Deciphering Outputs from the Exness Investment Calculator

1. Margin Requirements and Leverage Effects:

- Margin Requirements: This output shows the capital required to open and maintain your positions, influenced by the leverage and value of the position.

- Interpretation: Higher leverage permits larger positions with less capital, thereby lowering the margin requirements. However, this also increases risk exposure, highlighting the need for prudent leverage and margin management.

2. Spread Cost and Commissions:

- Spread Cost: Represents the trading cost incurred through the spread, which is the difference between the buy and sell prices.

- Interpretation: For strategies that involve frequent trades, such as scalping, benefiting from lower spreads can significantly reduce transaction costs.

- Commissions: These are fees charged per trade, depending on the account type and trading instrument.

- Interpretation: Knowing the commission structure is crucial as it affects the total trading cost, especially for those who trade in high volumes.

3. Swaps and Position Holding Costs:

- Swaps: These are overnight interest charges applied when a position is held open past the market close, based on the interest rate differentials between the traded currencies.

- Interpretation: Calculating swap costs is vital for traders holding positions long-term, as these can impact the overall profitability of the trades.

4. Pip Value for Trading Instruments:

- Pip Value: Indicates the impact of a one-pip movement in the exchange rate on the trade’s financial outcome.

- Interpretation: Understanding the pip value is critical for accurately calculating potential profits or losses from market moves. It is also essential for setting precise risk management tools, such as stop-loss orders.

Strategic Application of the Investment Calculator

By accurately interpreting the data from the Exness Investment Calculator, traders can enhance their understanding of how various factors such as leverage, spreads, and swaps affect their trades. This comprehensive approach allows for more informed decision-making and strategic planning, essential for navigating the complexities of forex trading and securing successful trading outcomes.

Utilizing the Exness Investment Calculator for Effective Trading Planning

Scenario: A trader is preparing to execute a trade on the EUR/USD currency pair and wants to forecast potential profits and calculate the required margin.

- Account Type: Standard

- Trading Instrument: EUR/USD

- Account Currency: USD

- Position Size: 1 lot (100,000 units)

- Entry Price: 1.1800

- Exit Price: 1.1850

- Leverage: 1:100

Steps to Use the Calculator:

- Select the Account Type:

- Choose ‘Standard’ from the dropdown menu to reflect specific trading conditions such as spreads and leverage.

- Input Trading Instrument:

- Enter ‘EUR/USD’ as the trading instrument to consider unique spread and margin requirements.

- Set the Account Currency:

- Ensure ‘USD’ is selected to have all calculations accurately reflect in the trader’s account currency.

- Enter the Position Size:

- Specify ‘1 lot’ or 100,000 units, important for determining the required margin and potential outcomes.

- Provide Entry and Exit Prices:

- Enter ‘1.1800’ as the entry and ‘1.1850’ as the exit. This 50 pip difference will be used to calculate the potential profit or loss.

- Choose Leverage:

- Set leverage at ‘1:100’, affecting the amount of margin needed to open and maintain the position.

Results Interpretation:

- Profit/Loss Calculation:

- The calculator will automatically compute the profit or loss based on the price movement from entry to exit. Here, the trader would see a profit from the 50 pip increase in the EUR/USD pair.

- Required Margin:

- The calculator will show how much capital is required to initiate the trade, considering the chosen leverage.

- Pip Value:

- It calculates the value of a single pip movement, which is crucial for this trade since the financial outcome hinges on the 50 pip change.

This example demonstrates how the Exness Investment Calculator can be effectively used to plan trades meticulously, providing traders with a clear understanding of potential earnings and financial implications of their trade settings.

Key Features of the Exness Investment Calculator

The Exness Investment Calculator is designed to enhance trading by providing detailed insights into potential financial outcomes and risk levels. Here are its main features:

- Profit Calculator:

- Projects potential profits or losses based on specified entry and exit points, trade size, and currency pairs, including considerations for spreads and fees.

- Forex Calculator:

- Essential for forex traders, this tool aids in currency conversions and calculations of margin requirements based on trade size and leverage.

- Leverage Calculator:

- Evaluates the impact of leverage on trades, helping traders understand potential exposure and the margin needed.

- Trading Calculator:

- Offers a holistic financial overview of trades by integrating the functionalities of profit, forex, and leverage calculators, providing insights into margins, pip values, and potential financial outcomes.

Benefits:

- Risk Management:

- Enables precise risk calculations per trade, helping traders maintain exposure within acceptable limits.

- Strategy Planning:

- Assists in detailed planning of trade parameters such as entry and exit points, expected returns, and stop-loss levels.

- Financial Optimization:

- Supports effective leverage utilization, balancing high return possibilities with potential risks.

Accessing the Calculator:

The Exness Investment Calculator can be accessed directly from the tools or resources section on the Exness website. Simply log into your Exness account to ensure that all calculations are customized to your specific trading conditions and account settings.

Frequently Asked Questions About the Exness Investment Calculator

What is the ideal leverage for a $10 account at Exness?

For a $10 account, conservative leverage is advisable, particularly for novice traders. While Exness offers leverage up to 1:2000, more prudent levels like 1:100 or 1:200 are recommended to help control risk effectively.