Let’s face it—managing money can feel overwhelming. Whether you’re saving for a rainy day, trying to get out of debt, or figuring out how to stretch your paycheck until the end of the month, having a clear plan can make a world of difference. That’s where the 50/20/30 budgeting rule steps in. It’s a simple, straightforward way to take control of your personal finances—without needing a finance degree or a fancy app.

In this post, we’ll break down the 50/20/30 rule in easy-to-understand language, explore how it can fit into your life, and provide real-life examples to help you apply it to your own budget. Ready to stop stressing about money and start telling it where to go? Let’s dive in!

Table of Contents

What Is the 50/20/30 Budget Rule?

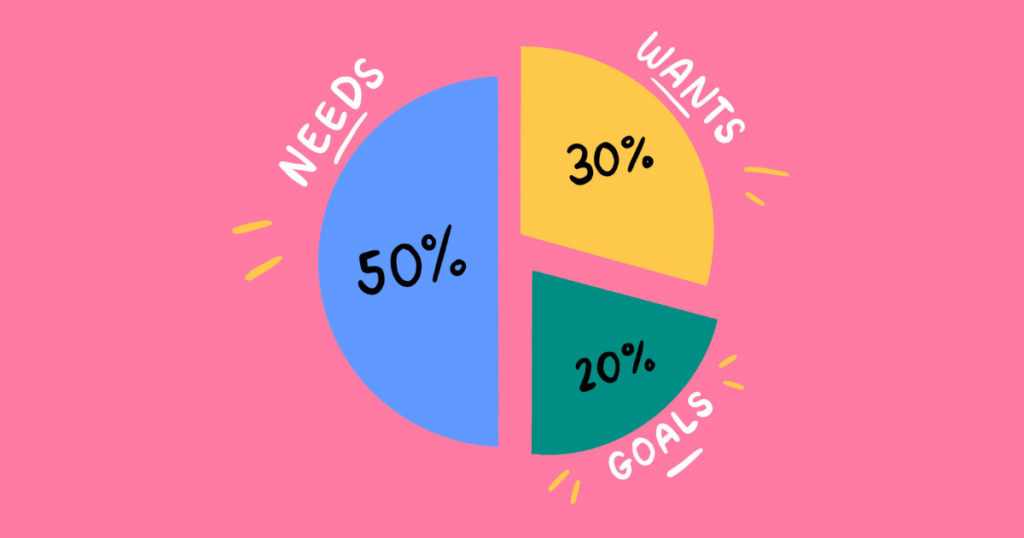

At its core, the 50/20/30 rule is a simple formula to help you manage your money by dividing your income into three spending categories:

- 50% for Needs

- 20% for Savings or Debt Repayment

- 30% for Wants

That’s it—just three categories. It’s a great budgeting method for beginners, but it’s also flexible enough to work for people with more complicated finances. Plus, because it’s based on percentages, it scales with your income. Whether you make $2,000 or $10,000 a month, the rule remains the same.

Let’s break these categories down one by one.

50% – Needs: Cover the Essentials

The first half of your take-home pay (after taxes) should go toward your basic, must-have expenses. These are the things you can’t live without—literally.

Examples of Needs:

- Rent or mortgage payments

- Utilities (electricity, water, gas)

- Groceries

- Transportation (car payments, gas, public transit)

- Insurance (health, auto, etc.)

- Minimum debt payments (like student loans)

Let me give you a quick example. Say you make $4,000 a month. Using the 50% rule, you’d aim to spend no more than $2,000 on your needs. That includes paying your rent, utility bills, and putting food on the table.

If your needs take up more than 50% of your income, don’t worry—this is a great time to evaluate where you might be able to make adjustments. For instance, could you save money by moving to a more affordable apartment? Or switching to a budget-friendly grocery list? A few tweaks can make a big difference.

20% – Savings & Financial Goals

Next, 20% of your paycheck should go straight toward building a better financial future. This category includes savings, investments, and paying off debt beyond the minimum balances.

Where Your 20% Might Go:

- Emergency fund

- Retirement savings (401(k), IRA)

- Extra loan or credit card payments

- Investments (stocks, bonds, index funds)

Back to our example—20% of $4,000 is $800. That money could go toward building your emergency fund or making an extra payment on your student loan. Over time, this category can help you build wealth, crush your debt, and stop living paycheck-to-paycheck.

One helpful tip: Automate your savings. Set up an automatic transfer from your paycheck to your savings account so it becomes a habit. “Pay yourself first,” as they say!

30% – Wants: Enjoy Life (Wisely)

This is the fun part! The remaining 30% of your budget can go toward your wants. These are non-essential expenses—the things that make life more enjoyable—but aren’t strictly necessary to survive.

Examples of Wants:

- Dining out

- Streaming subscriptions (Netflix, Spotify)

- Shopping and clothing

- Travel or vacations

- Fitness memberships

- Hobbies and entertainment

Using our same $4,000-a-month income example, you’d have $1,200 for lifestyle choices that bring you joy. That doesn’t mean you should blow it all, but it gives you the flexibility to enjoy spending—guilt-free—while staying financially responsible.

Quick side note: Sometimes, “wants” can sneak into the “needs” category. For instance, you may need a car—but you may not need a luxury SUV with heated seats. Keep that in mind when deciding what’s truly essential.

Why the 50/20/30 Rule Works

One of the best things about the 50/20/30 budgeting rule is its simplicity. You don’t have to track every dollar or categorize dozens of expenses. It gives you a big-picture framework that reduces budgeting stress, especially if you’re new to personal finance.

Here’s why this rule stands out:

- It’s easy to remember: Just three categories!

- It encourages savings: You prioritize financial goals before lifestyle spending.

- It’s flexible: Adjust as needed while still keeping the overall balance.

- It prevents burnout: You get to spend on things you enjoy—without guilt!

Plus, no matter where you are in life—just starting your career, building a family, or nearing retirement—the rule can adapt.

Personal Example: How the 50/20/30 Rule Helped Me

A few years ago, I felt like I was just treading water financially. I was paying my bills, but I couldn’t seem to save much. Once I started using the 50/20/30 rule, everything changed. I realized I was spending way too much on dining out (I’m talking $500+ a month!).

By trimming back and moving that money into savings, I finally built up a three-month emergency fund—something I’d never had before. And the best part? I still enjoyed a night out now and then, but with balance.

Tips for Making the 50/20/30 Rule Work for You

Ready to get started? Here are a few tips to set yourself up for success:

1. Know Your Take-Home Pay

Use your net income (what you take home after taxes and deductions) to calculate your 50/20/30 breakdown. This gives you a realistic number to work from.

2. Track Your Spending

Use a budgeting app (like Mint or YNAB), a spreadsheet, or good old-fashioned paper to track where your money is going. You might be surprised at how much you’re spending in certain categories.

3. Adjust as Needed

Budgets aren’t set in stone. Life changes—job loss, raises, new expenses—so let your budget evolve. The percentages are guidelines, not absolutes.

4. Set Mini-Goals

Want to save $5,000 for a vacation? Use your 20% to chip away at it every month. Goals keep you motivated and give your budget a purpose.

5. Be Honest with Yourself

Not every “need” is actually necessary, and not every “want” has to be cut out. Be realistic, but also be honest. You want a budget you’ll stick with—not one that makes you miserable.

When the 50/20/30 Rule Might Not Be Perfect

While this rule works well for many people, it’s not one-size-fits-all. You may need to tweak it depending on your situation.

If you’re in a high cost-of-living area or have significant student loan debt, your “needs” might take up more than 50% of your income. That’s okay. In those cases, try to stay below 60% for needs and adjust your wants accordingly.

If you’re aggressively paying off debt, you might devote more of your income—say 30%—to savings and debt repayment. That’s absolutely fine, too. The key is using this as a starting framework, then adjusting based on your personal goals and circumstances.

Who Should Use the 50/20/30 Rule?

This budgeting method is perfect if:

- You’re a beginner and want a simple system

- You want to balance saving with enjoying your income

- You struggle to categorize spending and want less detail

- You’re ready to stop overspending and start saving

That said, more detailed budgeters (especially those with irregular income) might prefer other methods like zero-based budgeting. The good news? There’s no “wrong” way to manage your money—the best budget is the one you’ll actually use.

How to Start Today

Don’t overthink it—getting started is the most important step. Here’s a quick game plan to follow:

- Figure out your total monthly income. Use your after-tax (net) amount.

- Apply the 50/20/30 breakdown. Multiply your income by each percentage to get your target numbers.

- Compare with your current spending. Are your needs under 50%? Are you saving at least 20%?

- Make small changes to move toward the ideal split. You don’t have to get it perfect right away—just start adjusting.

Conclusion: Take Control of Your Money with Confidence

The 50/20/30 budgeting rule is more than just numbers on a page. It’s a roadmap to financial freedom. By clearly separating your needs, wants, and savings, you can make intentional decisions about your money—without sacrificing everything you love.

Remember: It’s not about perfection—it’s about progress. So whether you’re living paycheck to paycheck or figuring out how to grow your savings, this simple budgeting method can help you take the first step toward a better financial future.

So, what are you waiting for? Try out the 50/20/30 rule this month and see how it feels. You might be surprised how empowering budgeting can be when it actually works for you.