- Exness’s Minimum Deposit Structure

- Understanding Exness’s Deposit Conditions

- Getting Started with Exness: A Step-by-Step Guide

- Exness Account Currency Options

- How to Deposit Money into Your Exness Account

- Ensuring the Security of Your Deposited Funds with Exness

- Exness Minimum Deposit: Frequently Asked Questions

Embarking on your trading journey with Exness requires an understanding of several key financial aspects, especially the minimum deposits necessary to open and maintain trading accounts. This guide aims to demystify these requirements to help newcomers initiate their trading ventures with confidence.

Exness’s Minimum Deposit Structure

This flexible minimum deposit structure allows traders to select an account type that best fits their financial capabilities and trading objectives. Here’s a further breakdown of Exness’s deposit framework and how it caters to various trader needs:

Understanding Exness’s Minimum Deposit Requirements

Geographic Variability

- Regional Differences: Exness recognizes the economic diversity across different regions and adjusts its minimum deposit requirements to accommodate local economic conditions and trading habits.

- Accessibility for All: By offering such flexibility, Exness ensures that traders from all financial backgrounds can access the forex market and other trading platforms.

Account Type Specifics

- Standard Accounts: These are designed with simplicity in mind, making them accessible for beginners who may not be ready or able to commit substantial funds. The possibility of starting with just $1 is an attractive feature for those new to trading, providing an opportunity to experience the market without significant risk.

- Professional Accounts: For traders who are more experienced and able to invest more capital, Professional accounts like Raw Spread, Zero, and Pro offer advanced features that can lead to potentially lower costs per trade and higher returns. The $200 minimum is positioned to balance accessibility with the serious nature of the trading strategies employed by professionals.

Advantages of Exness’s Minimum Deposit Structure

Catering to Diverse Trader Needs

- Flexibility and Choice: Traders can choose an account that aligns with their trading style and financial situation. Whether you are a beginner looking to learn the ropes with minimal risk or a seasoned trader aiming for greater market leverage, Exness offers suitable options.

- Gradual Upgrading: As traders gain experience and increase their investment capacity, they can easily transition to account types that provide more advanced trading conditions without having to switch platforms.

Supporting Trader Development

- Lower Entry Barriers: By keeping entry barriers low, Exness facilitates the participation of a broader audience in trading activities, supporting financial inclusivity.

- Education and Growth: The lower risk associated with smaller initial deposits allows traders to focus on developing their trading skills and understanding of market dynamics without the added pressure of high stakes.

Understanding Exness’s Deposit Conditions

Exness is renowned for its trader-friendly deposit conditions, which aim to enhance the trading experience by minimizing costs and maximizing efficiency. Here are some detailed insights into the key features of Exness’s deposit conditions:

Consider Currency Conversion Implications

- Currency Alignment: Ensure that the currency you deposit aligns with your account’s base currency to avoid conversion fees.

- Conversion Fees: If conversion is necessary, be aware that fees will be applied based on competitive market rates, which can vary and affect the amount credited to your trading account.

Benefit from Instant Processing

- Quick Access: Most deposits, especially those made through electronic payment methods or credit cards, are processed instantly.

- Market Readiness: This rapid processing ensures that funds are available almost immediately, enabling traders to respond swiftly to market movements and opportunities.

Commitment to Transparency

- No Hidden Fees: Exness prides itself on transparency, ensuring that all potential costs are disclosed upfront.

- External Fees: While Exness does not charge for deposits, fees may be imposed by external banks or payment processors, especially when dealing with international transfers or currency exchanges.

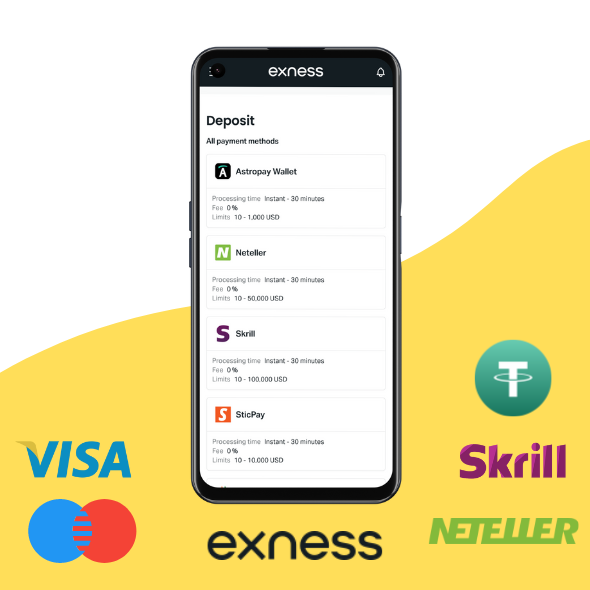

Diverse Payment Options

- Broad Selection: Exness supports a wide range of payment methods to cater to a global audience, including bank transfers, credit/debit cards, and popular e-wallets like Neteller, Skrill, and WebMoney.

- Regional Preferences: Payment methods are also tailored to meet regional needs, ensuring that traders from various countries can find options that are most convenient and cost-effective for them.

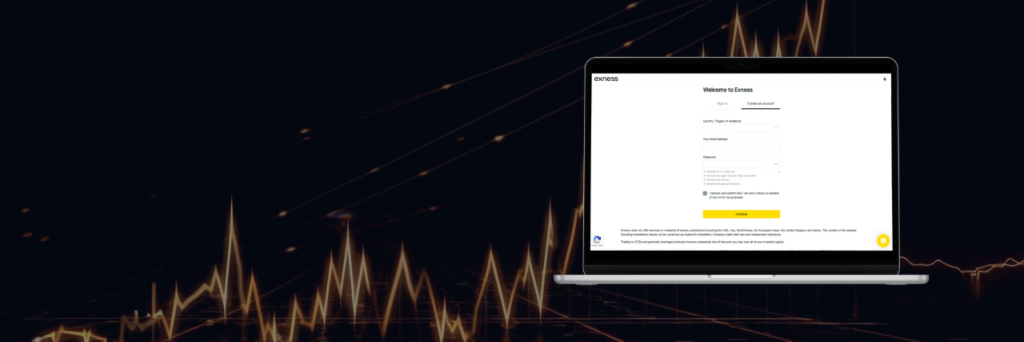

Getting Started with Exness: A Step-by-Step Guide

Step 1: Account Registration

- Sign Up: Visit the Exness website and fill out the registration form. This will require providing some personal information and setting up your login credentials.

- Verification Process: Complete the necessary KYC (Know Your Customer) steps to verify your identity and residence, which may include uploading documents such as a passport and a utility bill.

Step 2: Making Your Initial Deposit

- Deposit Requirements: Follow the specific minimum deposit requirements, which vary depending on the type of account you choose. These requirements are designed to cater to both novices and experienced traders.

- Fund Your Account: Use one of the supported payment methods to make your initial deposit. Adhering to these requirements will activate your account and prepare you for trading.

Step 3: Begin Trading

- Access Trading Platforms: With your account funded, you can now access Exness’s trading platforms to start trading. You’ll have access to various markets and instruments, from forex to commodities and indices.

- Utilize Tools and Resources: Take advantage of the trading tools, educational resources, and customer support provided by Exness to enhance your trading strategies and market understanding.

Maximizing Your Trading Experience with Exness

Understanding the deposit conditions and starting procedures at Exness not only helps in effective financial management but also ensures you are well-prepared to engage in trading activities. With Exness’s commitment to providing a supportive and transparent trading environment, you are equipped to navigate the financial markets effectively, making the most of your trading opportunities.

Exness Account Currency Options

Exness caters to a global clientele by offering a diverse range of account currency options. Traders can choose from currencies that best suit their geographical location or trading strategies. Below is a detailed enumeration of the currency options available for an Exness trading account:

- Major Global Currencies: USD (United States Dollar), EUR (Euro), GBP (British Pound Sterling), AUD (Australian Dollar), JPY (Japanese Yen), CHF (Swiss Franc), CAD (Canadian Dollar), NZD (New Zealand Dollar).

- Asian Currencies: CNY (Chinese Yuan), SGD (Singapore Dollar), HKD (Hong Kong Dollar), THB (Thai Baht), IDR (Indonesian Rupiah), MYR (Malaysian Ringgit), VND (Vietnamese Dong), KRW (South Korean Won), TWD (New Taiwan Dollar), JOD (Jordanian Dinar), ILS (Israeli New Shekel), PKR (Pakistani Rupee).

- Middle Eastern Currencies: SAR (Saudi Riyal), AED (United Arab Emirates Dirham), QAR (Qatari Riyal), BHD (Bahraini Dinar), OMR (Omani Rial), KWD (Kuwaiti Dinar).

- European Currencies: RUB (Russian Ruble), PLN (Polish Zloty), SEK (Swedish Krona), NOK (Norwegian Krone), DKK (Danish Krone), CZK (Czech Koruna), HUF (Hungarian Forint).

- Other Currencies: ZAR (South African Rand), MXN (Mexican Peso), TRY (Turkish Lira), BRL (Brazilian Real), CLP (Chilean Peso), PEN (Peruvian Sol), ARS (Argentine Peso), COP (Colombian Peso), UAH (Ukrainian Hryvnia), KZT (Kazakhstani Tenge), EGP (Egyptian Pound), BDT (Bangladeshi Taka).

- Cryptocurrencies: BTC (Bitcoin), ETH (Ethereum), LTC (Litecoin).

This broad spectrum of currencies reflects Exness’s dedication to accommodating traders by allowing them to manage their funds in the most cost-effective and convenient way, minimizing the need for costly currency conversions.

How to Deposit Money into Your Exness Account

Depositing funds into your Exness account is streamlined for efficiency, ensuring you can quickly engage in trading activities. Here’s a detailed guide to help you navigate the deposit process smoothly:

Step 1: Log Into Your Exness Personal Area

- Access the Website: Open your browser and navigate to the official Exness website.

- Secure Login: Enter your credentials to log into your Personal Area securely.

Step 2: Navigate to the Deposit Section

- Find the Deposit Option: Once logged in, locate the ‘Deposit’ section. This can typically be found directly on your dashboard or under a tab labeled ‘Finance’ or ‘Funds Management’.

Step 3: Select Your Preferred Deposit Method

- Choose a Payment Method: Exness offers a variety of deposit methods, including credit/debit cards, bank transfers, e-wallets like Skrill and Neteller, and cryptocurrencies like Bitcoin.

- Consider Convenience and Speed: Select a method that offers the best convenience and transaction speed for your needs.

Step 4: Specify Deposit Amount

- Enter Amount: Specify how much money you want to deposit into your account.

- Check for Limits and Fees: Be aware of any minimum or maximum limits and check if there are any fees associated with your chosen deposit method.

Step 5: Confirm Currency and Transaction Details

- Match Currency: Ensure the currency you are depositing matches your account’s base currency to avoid exchange rate fees.

- Double-Check Details: Verify all the transaction details are correct to prevent any delays or issues with the deposit.

Step 6: Complete Required Security Checks

- Security Protocols: Follow any prompted security measures, which may include two-factor authentication or a verification code sent to your linked mobile or email.

Step 7: Finalize Your Deposit

- Confirm and Submit: Review all information, confirm the details, and submit your deposit.

- Wait for Confirmation: Look for an on-screen confirmation and check your email for any notification from Exness regarding the transaction.

Step 8: Verify Your Account Balance

- Check Dashboard: Return to your dashboard to see if the funds have been added to your account.

- Transaction Time: Remember, while deposits like those from e-wallets are often instant, bank transfers may take longer depending on your bank’s processing times.

Additional Tips for a Smooth Deposit Process

Understand the Terms

- Read the Fine Print: Familiarize yourself with the terms and conditions of your chosen payment method. Knowing these can help avoid unexpected charges or delays.

Maintain Account Security

- Secure Connections: Always use a secure, private internet connection when making financial transactions to safeguard your personal and financial information.

Plan According to Processing Times

- Anticipate Delays: If using slower deposit methods like bank wires, plan your transactions ahead of market opportunities to ensure funds are available when needed.

Utilize Customer Support

- Get Assistance: If you encounter any issues during the deposit process, don’t hesitate to contact Exness customer support for help. They can provide guidance and solve any problems you may experience.

By following these detailed steps and tips, you can ensure that depositing money into your Exness account is a hassle-free process, allowing you to focus more on trading and less on the technicalities of fund management.

Ensuring the Security of Your Deposited Funds with Exness

Exness prioritizes creating a secure trading environment, implementing robust measures to protect client funds and personal data. Here’s an in-depth look at the security practices in place at Exness to ensure a secure trading experience.

Advanced Encryption Technology

Data Protection: Exness employs SSL (Secure Socket Layer) encryption to safeguard all data transmissions between clients and servers. This technology encrypts personal and transaction data, thwarting unauthorized access.

Two-factor Authentication (2FA)

Account Security: Two-factor authentication enhances account security by requiring both a password and a second form of verification, typically a code sent via SMS or an app notification. This additional layer significantly increases protection against unauthorized access.

Compliance with Financial Regulations

Regulatory Standards: Exness adheres to stringent international financial regulations designed to prevent money laundering, fraud, and other illicit activities, ensuring that all operations are conducted within legal frameworks.

Regular Security Audits

System Checks: Exness undergoes frequent internal and external security audits to identify and rectify potential vulnerabilities, maintaining the integrity of its security systems.

Secure Payment Gateways

Safe Transactions: Exness collaborates with well-established payment providers to process all financial transactions securely through trusted and reliable gateways.

Continuous Monitoring and Risk Management

Exness’s state-of-the-art monitoring systems operate 24/7 to instantly detect and address unauthorized access and potential fraudulent activities, safeguarding client assets effectively.

Comprehensive Data Privacy

Exness is committed to strict data protection standards, using advanced encryption technologies to ensure all client information is kept private and secure from any unauthorized access.

Customizable Security Settings

Traders at Exness can customize their security settings, enhancing protection with options like withdrawal confirmation codes, and alerts for logins and transactions, which fortify account safety.

Education and Awareness

Exness empowers its clients with extensive educational resources that help them understand how to identify and prevent security threats, fostering a safer trading environment.

Dedicated Support Team

A dedicated team of security professionals at Exness is available around the clock to assist with any security concerns, ensuring that clients can trade with confidence and receive immediate help whenever needed.

Incident Response Protocol

In the case of a security breach, Exness has a robust incident response protocol in place to quickly address and mitigate any threats, ensuring the continued security of client transactions and data.

By adopting these comprehensive security measures, Exness provides a secure platform where traders can manage their funds confidently and focus on their trading activities without concerns over the security of their financial assets.

Exness Minimum Deposit: Frequently Asked Questions

Here are answers to some frequently asked questions about the minimum deposit requirements and deposit processes at Exness, designed to assist traders in effectively managing their finances and understanding the platform’s financial operations.

Do I need to deposit in the same currency as my Exness account?

No, you do not need to deposit in the same currency as your account. If the currencies differ, Exness will apply a conversion at competitive exchange rates. Be aware of possible rate fluctuations which could affect the final amount credited to your account.