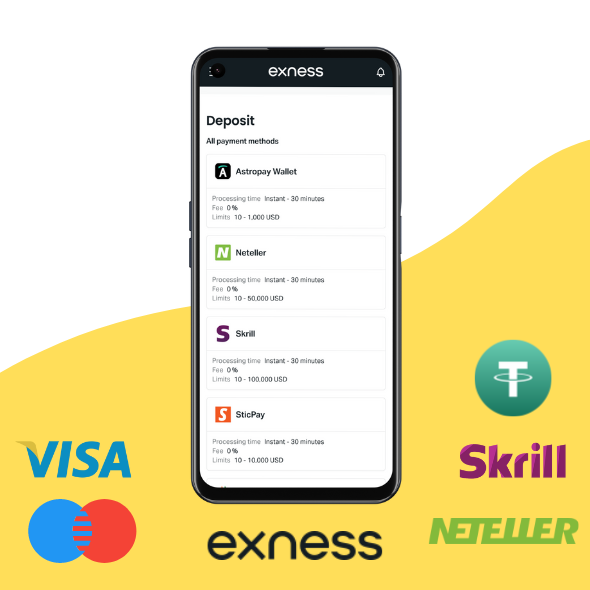

- Deposits

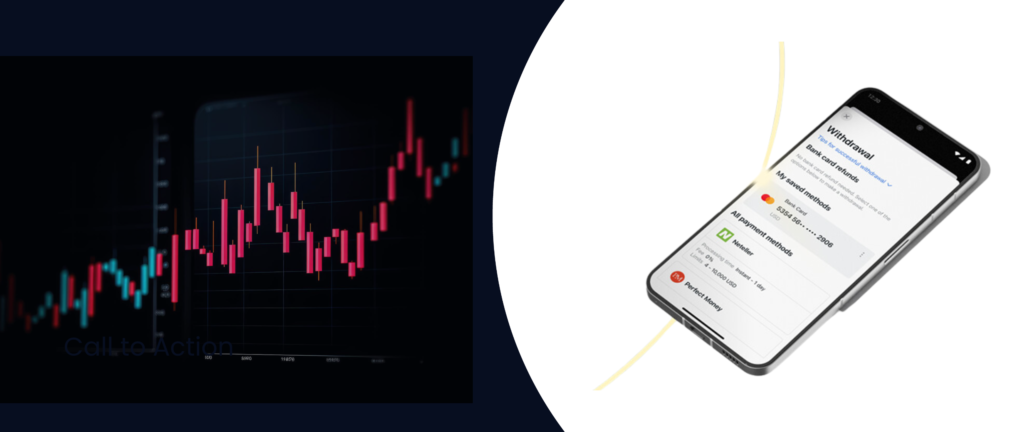

- Withdrawals

- Exness Payment Methods

- Base Currencies at Exness

- Making Deposits on Exness: A Comprehensive Guide

- Withdrawing Funds from Exness: Efficient and Flexible Methods

- Exness Transaction Security Measures: Comprehensive Safeguards for Secure Trading

- Tips for Ensuring Smooth and Secure Transactions at Exness

- Exness Payments FAQs

Exness provides an efficient and secure framework for handling both deposits and withdrawals, allowing traders to quickly access their funds and effectively engage in market activities. Below is a detailed examination of the processes for deposits and withdrawals at Exness, including the variety of payment methods and base currencies available.

Deposits

- Ease and Speed: Exness offers fast deposit capabilities across various payment methods, enabling traders to capitalize on market opportunities without delay.

- Security: All transactions are secured with advanced encryption technologies, ensuring the safety of your financial information and the integrity of your transactions.

Withdrawals

- Quick Processing: Exness is known for its speedy withdrawal processing times, with many transactions being instantaneous or completed within 24 hours, depending on the method used.

- Minimal Charges: Exness aims to minimize withdrawal fees. While no fees are typically charged by Exness, third-party fees from payment service providers may apply under certain conditions.

- Limits: Generally, there are no maximum withdrawal limits at Exness, though limits may depend on the payment method’s restrictions or the available balance in your account.

- Withdrawal Period: Withdrawal times can vary; while many are immediate, others may take from a few hours to several business days, depending on the payment method.

Exness Payment Methods

Exness supports a broad array of payment methods to accommodate its diverse global clientele, offering flexibility in how funds are deposited and withdrawn:

- Bank Wire Transfers: Ideal for larger transactions, although processing times may vary by bank.

- Credit/Debit Cards: Accepts major cards such as Visa and MasterCard, facilitating instant deposits and quick withdrawals.

- E-Wallets: Includes options like Neteller, Skrill, and WebMoney, known for their rapid processing times.

- Cryptocurrencies: Supports major cryptocurrencies like Bitcoin, offering a modern, secure, and cost-effective transaction method.

Base Currencies at Exness

To serve its international clientele, Exness allows traders to select from multiple base currencies, minimizing the need for currency conversions and associated costs:

- USD (United States Dollar)

- EUR (Euro)

- GBP (British Pound)

- JPY (Japanese Yen)

- AUD (Australian Dollar)

- CAD (Canadian Dollar)

- CHF (Swiss Franc)

- NZD (New Zealand Dollar)

This wide range of currencies enables traders to manage their accounts and participate in trading using the most cost-effective and convenient currency options, thus reducing exposure to exchange rate fluctuations.

Exness focuses on streamlining the deposit and withdrawal process with an emphasis on rapid execution, minimal fees, and robust security measures. Whether you are a beginner or an experienced trader, Exness offers comprehensive solutions to efficiently and effectively manage your trading finances.

Making Deposits on Exness: A Comprehensive Guide

Depositing funds into your Exness trading account is designed to be simple and efficient, allowing traders to effectively manage their finances. This detailed guide covers the steps for making deposits, along with insights into limits, fees, common issues, and the potential for available bonuses.

Exness Deposit Limits and Associated Fees

Deposit Limits:

- Minimum Deposit: This varies depending on the account type and deposit method. For instance, Standard Accounts may not require a minimum deposit, while Pro Accounts might have a higher initial deposit requirement.

- Maximum Deposit: There are generally no maximum deposit limits set by Exness, but your payment processor may impose its own limits.

Associated Fees:

- Deposit Fees: Exness usually does not charge fees for deposits. However, fees charged by payment processors or banks may apply, especially if currency conversion is involved.

- Currency Conversion: Depositing in a currency different from your account’s base currency may incur a conversion fee. This should be considered when selecting your account’s base currency.

Problems and Solutions for Exness Deposits

Common Deposit Issues:

- Transaction Not Processed: Issues like incorrect payment details or insufficient funds can block a deposit.

- Delayed Transactions: Most deposits are instant, but some methods, like bank transfers, may take longer, potentially delaying your trading.

Solutions:

- Verification of Details: Always ensure all payment details are accurate before initiating a deposit.

- Consult Payment Provider: If delays occur, check with your payment provider for any potential issues.

- Contact Exness Support: If a deposit hasn’t reflected in your trading account within the expected time, contacting Exness customer support can help resolve the issue quickly.

Exness Deposit Bonus

Availability of Deposit Bonuses:

- Promotional Offers: Exness sometimes offers deposit bonuses during promotional events, providing additional trading credit based on the deposited amount.

- Terms and Conditions: Be aware of the specific terms for each bonus, such as minimum deposit requirements and eligibility criteria, to fully benefit from these offers.

Benefits of Deposit Bonuses:

- Increased Trading Volume: Bonuses can enhance your trading capacity, allowing for larger or more frequent transactions.

- Risk Management: Additional funds can help diversify trading risks, providing greater flexibility in how you manage your trades.

Depositing at Exness is tailored to be user-friendly and supportive, accommodating a diverse array of payment methods and currencies to meet the needs of traders worldwide. While the system is designed to minimize complications, being prepared to tackle common issues can further enhance your trading experience. Moreover, taking advantage of promotional deposit bonuses when available can significantly boost your trading strategy and capital efficiency. Understanding the terms associated with these bonuses is crucial to making the most of the benefits they offer for your trading capital.

Withdrawing Funds from Exness: Efficient and Flexible Methods

Withdrawing funds from your Exness account is designed to be simple and accommodating, providing a variety of methods that cater to the diverse needs of traders globally. This guide details how to effectively withdraw funds using Skrill and provides an overview of general withdrawal times at Exness.

Skrill Withdrawals at Exness

How to Withdraw Using Skrill:

- Log into Your Personal Area: Start by accessing your Exness Personal Area with your login credentials.

- Select ‘Withdraw’: Navigate to the ‘Withdrawal’ section and select Skrill from the list of available methods.

- Enter Withdrawal Details: Specify the amount you wish to withdraw and ensure that the email linked to your Skrill account is correct.

- Confirm the Transaction: Follow the on-screen prompts to confirm your withdrawal. You may need to verify the transaction with a code sent to your email or phone for added security.

Advantages of Using Skrill:

- Speed: Withdrawals through Skrill are usually processed instantly after approval, making funds available in your Skrill account within minutes.

- Low Fees: Skrill is known for its low transaction fees, making it a cost-effective option for traders.

- Ease of Use: The user-friendly interface of Skrill facilitates quick and hassle-free transactions.

Considerations:

- Ensure that the email addresses for your Exness and Skrill accounts match to avoid delays or issues during the withdrawal process.

General Withdrawal Times at Exness

Instant Withdrawals:

- Most e-wallet withdrawals, including Skrill, are processed instantly, meaning transactions are typically completed within minutes.

Bank Transfers and Credit Cards:

- Withdrawals to bank accounts or via credit/debit cards usually take longer, from several hours to a few business days, depending on bank processing times.

Factors Affecting Withdrawal Times:

- Verification Status: Fully verified accounts usually experience faster and smoother withdrawals.

- Withdrawal Amount: Larger withdrawals may require additional security checks, potentially extending processing times.

- Payment Service Providers: The efficiency of the payment service provider or bank also affects withdrawal speeds.

Tips for Efficient Withdrawals:

- Verify Your Account Early: Complete all required KYC procedures before you plan to make your first withdrawal to ensure smooth processing.

- Follow Withdrawal Limits: Be aware of and adhere to the withdrawal limits set by both Exness and your chosen payment method to avoid complications.

- Regularly Update Payment Details: Keep your payment method information current to prevent delays or rejections of your withdrawal requests.

Using Skrill for withdrawals from Exness offers a mix of speed, convenience, and security, making it a preferred option among traders. By understanding typical withdrawal times and factors influencing these durations, traders can manage their financial transactions more effectively, ensuring timely access to funds when needed. This comprehensive approach to managing withdrawals enhances the overall trading experience, enabling traders to focus more on their trading strategies and less on administrative tasks.

Exness Transaction Security Measures: Comprehensive Safeguards for Secure Trading

Exness is committed to providing a secure trading environment by implementing rigorous security measures that protect client funds and personal information. This ensures that traders can focus on their trading activities with confidence, knowing their data and assets are well-protected.

Advanced Encryption Technology

Data Protection: Exness utilizes state-of-the-art SSL (Secure Socket Layer) encryption technology to secure all data transmissions between clients and servers. This encryption ensures that personal information, transaction details, and all communication are encoded and protected from unauthorized interception.

Two-factor Authentication (2FA)

Enhanced Account Security: To fortify account security further, Exness implements two-factor authentication (2FA), which requires not only a password and username but also a second form of verification. This could be a code sent via SMS, an email notification, or a prompt through a secure authentication app. This dual-validation process significantly diminishes the risk of unauthorized access, making it exceedingly difficult for intruders to compromise account security.

Compliance with Financial Regulations

Adherence to International Standards: Exness strictly complies with international financial regulations, including those set by major regulatory bodies such as the FCA (Financial Conduct Authority) and CySEC (Cyprus Securities and Exchange Commission). These regulations enforce robust measures against money laundering, fraud, and other forms of financial malpractice, ensuring that all customer transactions are conducted within a secure and regulated environment.

Regular Security Audits

Proactive Vulnerability Assessments: To maintain and enhance its security frameworks, Exness conducts regular security audits both internally and with third-party security firms. These audits are crucial in detecting and addressing potential vulnerabilities within the trading platform and associated systems, ensuring the security infrastructure remains resilient against evolving cyber threats.

Secure Payment Gateways

Trusted Transaction Processing: Exness partners with reputable financial institutions and payment providers to ensure that all financial transactions, including deposits and withdrawals, are processed securely. This partnership involves the use of verified and secure payment gateways that provide additional layers of security to every transaction.

Continuous Security Training and Awareness

Educating Staff and Clients: Exness invests in continuous security training for its staff to ensure they are aware of and can effectively respond to the latest security threats and challenges. Additionally, Exness provides its clients with resources and guidelines on how to secure their trading activities and personal data against potential threats.

Monitoring and Incident Response

Real-Time Surveillance and Rapid Response: Exness has implemented sophisticated monitoring systems that continuously watch over trading activities and system operations to detect and respond to suspicious activities quickly. In the event of a security breach, Exness has a robust incident response protocol in place to mitigate risks, address the breach, and restore secure operations as swiftly as possible.

Client Education on Security Practices

Empowering Traders: Exness believes in empowering its clients with the knowledge to protect their accounts. This includes providing tips on creating strong passwords, recognizing phishing attempts, and securely managing personal and financial information.

By integrating these comprehensive security measures, Exness ensures that it not only meets but exceeds the industry standards for safety and security in online trading. These efforts collectively foster a trading environment where clients can concentrate on their trading goals, assured that their investments and personal data are in safe hands.

Tips for Ensuring Smooth and Secure Transactions at Exness

To ensure your trading experience with Exness remains secure and efficient, here are additional tips and practices to follow:

Advanced Security Settings

- Enable Multi-Factor Authentication: Beyond two-factor authentication, consider enabling any additional security features offered by Exness. These might include biometric verifications like fingerprint or facial recognition, which provide an extra layer of security.

- Customize Security Notifications: Set up customized alerts for various activities, such as logins from new devices or large transactions. These notifications can help you stay informed of any unusual activities immediately.

Personal Data Protection

- Limit Sharing of Sensitive Information: Be cautious about where and how you share your personal information, especially on social platforms or unverified websites. Keep sensitive data confined to secure, necessary platforms only.

- Secure Personal Devices: Ensure that any device you use for trading is secured with a password or biometric lock. This includes mobile devices, tablets, and personal computers. Regularly update your operating systems and applications to mitigate security risks.

Financial Safety Measures

- Conduct Regular Financial Reviews: Periodically review your transaction history and account statements to verify all activities are as expected. This regular check helps detect discrepancies early and addresses them promptly.

- Diversify Withdrawal Methods: If possible, diversify your withdrawal methods. This not only minimizes dependency on a single service but can also reduce risks associated with specific payment gateways.

Educating Yourself on Security Risks

- Stay Informed about Trading Security: Educate yourself on the latest security threats and safe trading practices. Exness often provides resources and updates on how to safeguard your trading environment.

- Participate in Security Webinars and Trainings: Engage in any webinars or training sessions offered by Exness. These sessions are valuable for learning direct from experts about protecting your investments.

Response to Security Incidents

- Understand Incident Response Procedures: Familiarize yourself with Exness’s procedures for handling security breaches. Knowing whom to contact and how to react can significantly reduce potential damages in case of an incident.

- Keep Emergency Contacts Handy: Maintain a list of essential contacts, such as Exness’s support and security teams, readily accessible in case you need to address security concerns quickly.

By integrating these practices, you can enhance the security of your trading operations at Exness and ensure that your transactions are protected against potential threats. These strategies not only help safeguard your financial assets but also contribute to a stress-free trading experience.

Exness Payments FAQs

What payment methods are available at Exness?

Exness supports a variety of payment methods, including bank wire transfers, credit/debit cards (Visa, MasterCard), e-wallets (Skrill, Neteller, WebMoney), and cryptocurrencies. Available options may vary by country.