- Online Account Setup with Exness:

- Setting Up Your Exness Account via Mobile App:

- Exness Account Verification Guide:

- Choosing the Ideal Exness Account Type for Your Trading Needs

- How to Deposit Funds into Your Exness Account: A Comprehensive Guide

- Overcoming Common Registration Challenges at Exness

- Enhancing Your Trading Effectiveness with Exness: Comprehensive Strategies

- Essential FAQs for Setting Up Your Exness Account

Embark on your trading journey with Exness, where you have the option to trade actively or test strategies using a demo account. Follow these detailed steps to set up your account either through the website or using the mobile app.

Online Account Setup with Exness:

- Visit the Exness Website: Navigate to www.exness.com using your preferred web browser.

- Registration: Click on the ‘Register’ button, typically located in the upper right corner of the homepage.

- Enter Your Details: Provide your email address and set a secure password.

- Verify Your Email: Look for a verification email from Exness and click the link to verify your email address.

- Complete Your Profile: Fill in additional personal details such as your full name, date of birth, and contact information.

- Identity Verification: Upload clear scans or photos of a government-issued ID and a recent utility bill or bank statement for address verification.

- Select Account Type: Choose the account type that suits your trading needs, like Standard, Pro, or Cent.

- Fund Your Account: Deposit funds using one of the many payment methods offered by Exness (this step is optional for demo accounts which are preloaded with virtual funds).

- Start Trading: Begin trading on platforms such as MetaTrader 4 or MetaTrader 5.

Setting Up Your Exness Account via Mobile App:

- Download the App: Download the Exness Trader app from the Google Play Store or Apple App Store.

- Sign Up: Open the app, tap ‘Sign Up’, and register using your email and password.

- Email Verification: Confirm your email by clicking the verification link sent by Exness.

- Complete Your Profile: Input necessary personal information such as your name, date of birth, and address.

- Verify Your Identity: Upload images of your ID and a document for proof of address directly from your mobile device.

- Choose Your Account Type: Select an account type based on your trading expertise and preferences.

- Deposit Funds: Follow prompts in the app to deposit funds if you intend to trade with real money (this step is optional for demo accounts).

- Start Trading: Use the app’s extensive trading tools to engage in trading.

Whether using the website or mobile app, Exness makes the account setup process intuitive and quick, facilitating a smooth entry into the world of trading.

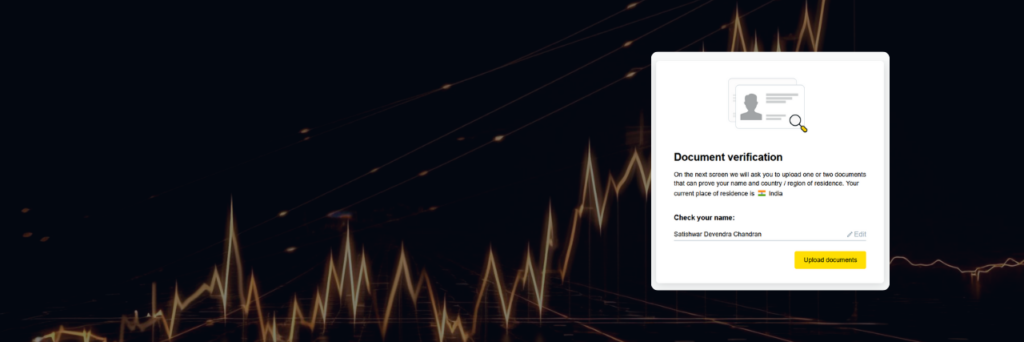

Exness Account Verification Guide:

- Log In: After registration, log into your Exness Personal Area to manage your account.

- Initiate Verification: Navigate to ‘Profile’ or ‘Account Settings’ and begin the verification process.

- ID Verification:

- Document Requirements: Upload a clear, valid photo ID such as your passport, national ID, or driver’s license.

- Submission: Use the upload feature in the Personal Area or the Exness app.

- Address Verification:

- Document Requirements: Provide a recent proof of residency, like a utility bill or bank statement, that shows your name and address.

- Submission: Upload the document through the Personal Area.

- Additional Verification (if required):

- Extra Documents: Additional documentation might be necessary based on specific account conditions or regulatory needs.

- Await Confirmation: Verification times can vary; Exness will notify you via email or through your Personal Area once your documents are approved.

- Update Your Details: Maintain current personal information, especially after any changes, to ensure continuous smooth operations.

Verification Tips:

- Clarity: Ensure all documents are clear and legible.

- Guidelines: Adhere closely to the specific requirements and guidelines for documents.

- Formats: Ensure your documents are in accepted formats and within the size limits.

Following these steps will help you set up and verify your Exness account thoroughly, laying the groundwork for a successful and secure trading experience.

Choosing the Ideal Exness Account Type for Your Trading Needs

Selecting the right account type at Exness is crucial for matching your trading aspirations, skill level, and financial strategies. This detailed overview will help you navigate through the options available, ensuring you pick the account that best suits your requirements—be it a Standard, Professional, or choosing between a Demo and a Real account.

Standard Accounts

Features:

- Minimum Deposit: None, offering flexibility in funding.

- Spreads: Begin at 0.3 pips, providing cost-effective trading opportunities.

- Leverage: Up to 1:2000, allowing extensive market leverage.

- Commission: None, facilitating lower overall trading costs.

- Ideal For: Both beginners and intermediate traders looking for simple and direct trading conditions.

Benefits:

- Accessible for traders at all levels due to no minimum deposit.

- User-friendly interface, ideal for those new to Forex trading.

- Supports both MT4 and MT5 platforms, catering to diverse trading preferences.

Professional Accounts

Features:

- Minimum Deposit: Typically starts at $200, catering to more serious traders.

- Spreads: Can be as low as 0.0 pips in Raw Spread accounts, perfect for high-frequency trading.

- Leverage: Also up to 1:2000, suited for bold trading tactics.

- Commission: Depends on the account type, with Raw Spread and Zero accounts involving per-trade commissions.

- Ideal For: Advanced traders and professionals looking for premium features and quick execution for intricate strategies.

Benefits:

- Highly competitive spreads which reduce costs on large transactions.

- Provides market execution with no re-quotes, essential for scalping and high-frequency trading.

- Equipped with advanced trading tools and features tailored for high-level trading.

Utilizing Demo and Real Accounts at Exness

Demo Account:

- Purpose: Offers a secure, risk-free setting with virtual funds to practice trading strategies and simulate real market conditions.

- Ideal For: Beginners to grasp trading essentials and experienced traders to fine-tune strategies.

Real Account:

- Purpose: Engages real funds, where the outcomes are tangible profits or losses.

- Ideal For: Traders who are ready to face market challenges and aim for actual financial gains.

How to Choose

- Skill Level: New traders should begin with a demo account to safely learn trading dynamics. Shift to a real account when you feel confident in your trading skills.

- Strategy Testing: Use the demo account to thoroughly test and refine strategies risk-free before applying them in real market conditions.

- Psychological Preparedness: Be aware that real money trading involves emotional stress. Make sure you are mentally ready for the implications of real trading before moving from a demo to a real account.

This guide aims to assist you in selecting the most appropriate Exness account tailored to your trading style and objectives, providing a solid foundation for your trading endeavors.

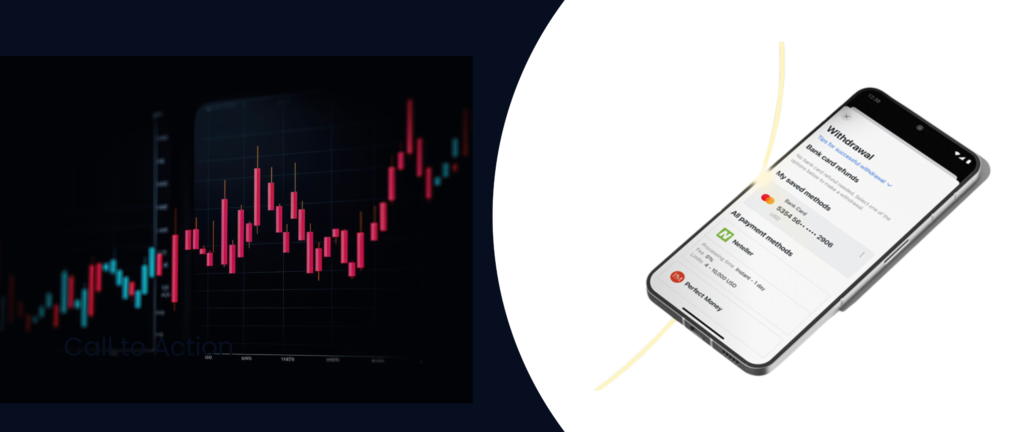

How to Deposit Funds into Your Exness Account: A Comprehensive Guide

Accessing Your Personal Area:

- Action Required: Log in to the Exness platform through the official website or mobile app. Make sure you are connected to a stable and secure internet connection to facilitate a smooth transaction.

Navigating to the Deposit Section:

- Location: Once logged in, head to the ‘Finance’ section on your dashboard. Here, you will find the ‘Deposit’ option, which will direct you to the various funding methods.

Selecting Your Preferred Deposit Method:

- Options Available: Exness caters to a wide range of preferences by offering multiple deposit methods:

- Bank Transfers: Best for larger deposits, though these may take longer to process.

- Credit/Debit Cards: Including Visa and MasterCard, typically provide instant deposit capabilities.

- E-Wallets: Options like Skrill, Neteller, and others are favored for quick processing and potentially lower fees.

- Cryptocurrencies: Offer enhanced security features and can facilitate faster transactions than traditional methods.

Entering Deposit Details:

- Details Required: Input the amount you want to deposit. Depending on the method you select, additional details such as card numbers for credit/debit cards or account identifiers for e-wallets may be necessary.

Confirming and Completing the Transaction:

- Security Measures: For most electronic payments, you will be redirected to a secure payment gateway where you must authenticate the transaction. This might involve two-factor authentication or an SMS verification to enhance security.

- Transaction Review: Double-check all details for accuracy before finalizing the deposit to ensure the funds are processed without any issues.

Verifying Your Account Balance:

- Check Balance: After the deposit, revisit your dashboard on Exness to confirm that the funds have been properly credited to your account. While electronic methods usually reflect the deposit instantly, methods like bank transfers may take longer.

Receipt and Record Keeping:

- Confirmation Email: Keep the confirmation emails sent by Exness for each transaction as they contain vital details of the deposit.

- Account Statements: Regularly check your account statements in the Personal Area to monitor all transactions and verify their accuracy.

Additional Tips for a Smooth Deposit Process:

- Understand Fees and Limits: Be aware of any applicable fees or transaction limits imposed by your bank or payment provider before initiating a deposit.

- Currency Considerations: To avoid conversion fees, try to deposit funds in the same currency as your trading account. Exness supports various currencies, offering greater flexibility.

- Customer Support: Should you face any issues during the deposit process, Exness’s customer support is available 24/7 to provide assistance with transaction failures, delayed funds, or other concerns.

By adhering to these detailed steps and utilizing the additional tips, you can streamline your deposit process at Exness, ensuring it is not only efficient but also secure. This preparation allows you to dedicate more time to trading and less to managing transactions.

Overcoming Common Registration Challenges at Exness

Challenges in Account Registration

- Issue: Difficulty registering due to regional restrictions, incorrect information entry, or technical issues.

- Solution: Verify that Exness offers services in your area. Ensure all data entered is accurate and consider using a different browser or device if issues persist.

Password Setup Complications

- Issue: Passwords not meeting Exness’s security requirements or encountering system errors during setup.

- Solution: Make sure your password adheres to Exness’s criteria, which may include specific lengths and characters. Contact customer support if the problem continues.

Problems Uploading Verification Documents

- Issue: Documents are in improper formats or sizes, or the uploaded images are unclear.

- Solution: Check that all documents are in accepted formats like JPEG or PDF and within the allowed size limits. Ensure documents are clear and re-upload if necessary.

Login Difficulties

- Issue: Errors due to incorrect credentials or potential account restrictions.

- Solution: Carefully re-enter your login details. If login issues do not resolve, or if you suspect an account restriction, reach out to Exness customer support.

These steps can assist you in navigating through common registration and account setup issues, helping ensure a smooth start with your Exness trading account.

Enhancing Your Trading Effectiveness with Exness: Comprehensive Strategies

Practice and Experimentation

- Approach: Utilize Exness’s demo accounts to test various strategies without financial risk.

- Tip: Experiment with different financial instruments to gauge market reactions under various economic conditions.

Educational Advancement

- Approach: Leverage Exness’s educational resources, including webinars and tutorials, to deepen your understanding of market dynamics.

- Tip: Engage with community forums and discussion groups to exchange trading strategies and insights.

Utilization of Advanced Tools

- Approach: Employ technical indicators and Expert Advisors (EAs) to enhance your trading efficiency and effectiveness.

- Tip: Customize alerts to keep track of significant market movements and economic announcements, reducing the need for constant monitoring.

Rigorous Risk Management

- Approach: Implement strict risk management protocols, such as setting stop-loss orders, to safeguard your investments.

- Tip: Apply percentage-based risk management to maintain a balance between potential profits and risks.

Stay Informed

- Approach: Regularly consult the economic calendar and stay updated with real-time market news to make informed trading decisions.

- Tip: Automate adjustments in your trading positions in response to news with the help of news filters on your trading platform.

Continuous Strategy Evaluation

- Approach: Regularly review and adjust your trading strategies based on performance analysis and market conditions.

- Tip: Keep a detailed log of your trades to identify successful strategies and common errors, adjusting your methods accordingly.

Advanced Trading Techniques

- Explore complex strategies like scalping for quick profits, hedging for risk management, and options trading for leveraging market movements.

By adopting these strategies and fully utilizing the tools and resources offered by Exness, you can significantly enhance your trading performance, adapting to market changes and optimizing your trading outcomes effectively.

Essential FAQs for Setting Up Your Exness Account

What documents do I need to register for an Exness account?

To set up an account with Exness, you must provide a government-issued identification (passport, driver’s license, or national ID) for identity proof and a recent utility bill or bank statement (no older than six months) to confirm your residential address.