Investing can feel uncertain, even intimidating. Markets rise and fall, headlines create panic, and many people struggle to know which strategies really work. But history gives us a powerful guide: the lessons of the world’s greatest investors.

These individuals didn’t just make money—they shaped the way millions of people think about investing. Some built empires by buying undervalued companies. Others pioneered new ideas, like global diversification or low-cost index funds. A few became legends for bold, high-risk bets that paid off.

Studying these investors is valuable because it shows that there isn’t only one path to success. Different styles—value, growth, macro, or passive—can all work if applied with discipline, patience, and skill. By looking at their lives and strategies, we gain insight into principles that ordinary investors can apply today.

In this article, we’ll look at 12 of the greatest investors of all time, what made them unique, and the lessons we can learn from each.

Table of Contents

The Criteria for “Greatness”

What makes an investor “great”? It’s not just about who made the most money. Greatness comes from a mix of qualities that stand the test of time:

- Long-term performance: Consistently strong returns over decades, not just a lucky year or two.

- Influence on investing philosophy: Did their ideas change how others approach markets? For example, John Bogle made index funds a global standard.

- Legacy and impact: Many of the greatest investors shared their wisdom through books, interviews, or teaching. Their lessons continue to guide new generations.

- Adaptability: The ability to adjust strategies when markets or conditions change, instead of clinging to outdated methods.

- Discipline: Perhaps the most important trait. Great investors stay patient, stick to their principles, and don’t let fear or greed control their decisions.

By these measures, the 12 investors in this list stand out as giants in the history of finance. Each followed a different path, but their combined lessons form a roadmap for smarter investing.

1. Warren Buffett – The Oracle of Omaha

Warren Buffett is often called the greatest investor of all time. Through his company, Berkshire Hathaway, he turned a struggling textile mill into one of the most valuable corporations in the world. His approach is built on value investing—buying strong companies at fair prices and holding them for the long term.

Buffett is famous for his discipline and patience. He avoids trends and speculation, focusing instead on businesses with durable advantages, trustworthy management, and consistent earnings. His most well-known investments include Coca-Cola, American Express, and Apple.

Lesson: Be patient, buy quality businesses, and think long-term. As Buffett himself says, “Our favorite holding period is forever.”

2. Benjamin Graham – The Father of Value Investing

Benjamin Graham was not only a great investor but also a great teacher. He wrote two classic books—Security Analysis and The Intelligent Investor—which laid the foundation for modern value investing. Warren Buffett himself was one of Graham’s students at Columbia University.

Graham’s philosophy was simple but powerful: always look for a “margin of safety.” This means buying stocks that are priced lower than their true value, so even if things go wrong, the downside is limited. He believed investing should be more like running a business—rational, careful, and based on facts, not emotions.

Lesson: Focus on intrinsic value and protect yourself with a margin of safety. Don’t chase hype; buy when prices are lower than what a company is truly worth.

3. Peter Lynch – Invest in What You Know

Peter Lynch became famous as the manager of the Fidelity Magellan Fund, which he ran from 1977 to 1990. During that time, the fund grew from $18 million to over $14 billion, with annual returns of around 29%. That performance made him one of the most successful mutual fund managers in history.

Lynch’s trademark advice was to “invest in what you know.” He encouraged everyday investors to look at the products and services they use daily—like a favorite store, restaurant, or technology—and consider whether those companies might be good investments. He believed ordinary people often spot trends before Wall Street analysts do.

Lesson: Pay attention to the world around you. Your personal experiences and observations can lead you to great investments before they become mainstream.

4. John Templeton – The Global Pioneer

Sir John Templeton was one of the first major investors to look beyond his home market and embrace a global approach. At a time when many investors focused only on domestic companies, Templeton searched worldwide for bargains.

He became famous for buying stocks when others were fearful. During World War II, he bought shares of 100 small U.S. companies trading at low prices, many of which later grew significantly. His Templeton Growth Fund became one of the most successful international funds of its time.

Lesson: Don’t limit yourself to your home market. Opportunities exist worldwide, and sometimes the best value is found where others aren’t looking.

5. Philip Fisher – Growth Investing Visionary

Philip Fisher is often considered the father of growth investing. His classic book, Common Stocks and Uncommon Profits, taught investors to focus on companies with strong long-term potential rather than just cheap valuations.

Fisher believed in studying a company deeply—talking to management, employees, suppliers, and customers to understand its strengths. He called this the “scuttlebutt method.” His philosophy was that if you find a truly great business, you should hold it for years or even decades.

Lesson: Look beyond numbers. Study a company’s leadership, innovation, and long-term prospects. If it’s a great business, patience will reward you.

6. George Soros – The Bold Speculator

George Soros is best known as a hedge fund manager and one of the most successful macro investors in history. His most famous trade came in 1992, when he bet heavily against the British pound, earning over $1 billion in profit in a single day.

Unlike Buffett or Graham, Soros thrived on short-term, high-stakes bets based on his view of global economic and political trends. His ability to act boldly when opportunities arose set him apart. At the same time, he managed risk carefully and was quick to exit when he saw he was wrong.

Lesson: Be bold when you have conviction, but always manage risk. Soros showed that decisive action, combined with flexibility, can lead to extraordinary results.

7. Ray Dalio – Principles and Big Picture Thinking

Ray Dalio is the founder of Bridgewater Associates, one of the world’s largest hedge funds. His success comes from focusing on macro trends—the big forces shaping economies, like interest rates, debt cycles, and global trade.

Dalio is also famous for his book Principles, where he shares the decision-making rules that guided his investing and management style. He emphasizes diversification, studying history to understand patterns, and being radically open-minded when evaluating ideas.

Lesson: Understand the big picture. Don’t just look at individual stocks—study the broader economy and build principles that guide consistent decision-making.

8. John Bogle – Champion of the Everyday Investor

John Bogle, founder of Vanguard, revolutionized investing by creating the first index fund in 1976. At the time, many dismissed the idea of simply tracking the market. But Bogle’s vision of low-cost, diversified, long-term investing became a movement.

Today, trillions of dollars are invested in index funds and ETFs, saving everyday investors billions in fees. Bogle proved that you don’t need to beat the market to succeed—you just need to participate consistently at low cost.

Lesson: Keep investing simple and affordable. Low fees, diversification, and patience are often more powerful than chasing “hot” stock picks.

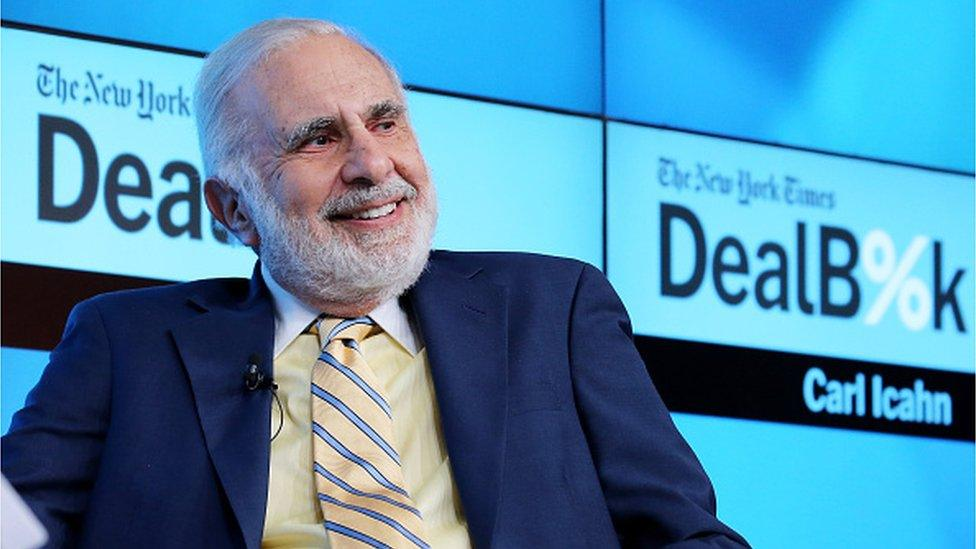

9. Carl Icahn – The Activist Investor

Carl Icahn made his name as an activist investor. Instead of quietly buying stocks, Icahn took large positions in companies and then pushed for changes—like restructuring, selling assets, or cutting costs—to increase shareholder value.

He earned a reputation as a tough negotiator who wasn’t afraid to challenge management. While controversial, Icahn’s approach often unlocked value in underperforming companies and made him one of Wall Street’s most influential figures.

Lesson: Sometimes the greatest returns come not just from owning businesses but from improving them. Icahn showed the power of being active, bold, and willing to demand change.

10. Charlie Munger – The Thinker Behind the Thinker

Charlie Munger is best known as Warren Buffett’s longtime partner at Berkshire Hathaway. While Buffett gets most of the public attention, Munger’s influence is undeniable. He encouraged Buffett to move beyond buying only cheap companies and instead focus on “great businesses at fair prices.”

Munger is also famous for his concept of mental models—drawing on ideas from multiple disciplines like psychology, history, and math to make better decisions. His sharp wit and blunt wisdom made him one of the most respected voices in investing.

Lesson: Think broadly and logically. Success comes from combining rational analysis with insights from different fields, not just finance.

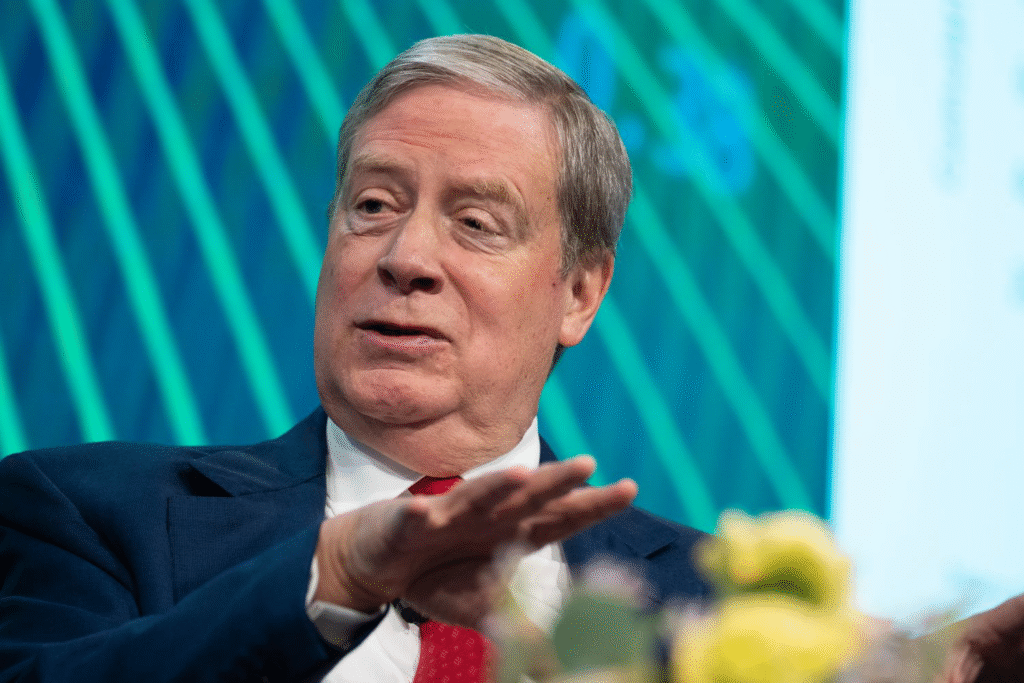

11. Stanley Druckenmiller – The Consistent Macro Master

Stanley Druckenmiller built his reputation as one of the greatest macro investors. He worked with George Soros at the Quantum Fund and played a key role in the legendary bet against the British pound in 1992. But what truly sets Druckenmiller apart is his consistency.

Over three decades, he reportedly never had a losing year while managing money. He focused on global economic trends, interest rates, and currencies, and wasn’t afraid to make bold moves when opportunities appeared.

Lesson: Focus on consistency, not just big wins. By carefully balancing risk and conviction, Druckenmiller proved that steady discipline can achieve extraordinary results.

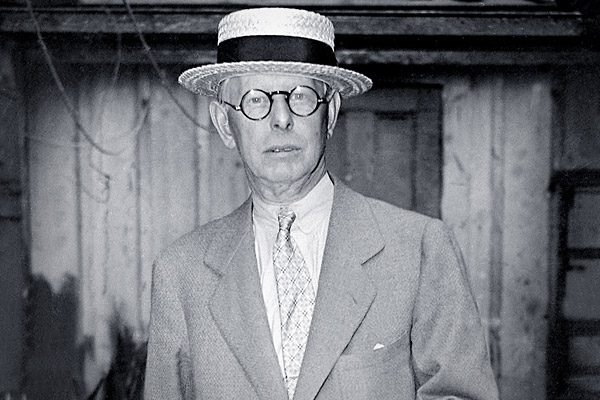

12. Jesse Livermore – The Speculator’s Legend

Jesse Livermore, known as the “Boy Plunger,” was a legendary trader of the early 20th century. He made and lost several fortunes but became famous for his ability to profit during market crashes, including the 1907 and 1929 crashes.

Livermore’s story is a cautionary tale as much as an inspiration. He emphasized the importance of discipline, patience, and following trends, but he also struggled with risk management and personal challenges. His life shows both the highs and the dangers of speculation.

Lesson: Speculation can bring huge rewards, but without strict discipline and risk control, it can also lead to ruin. Livermore’s experiences remind us that psychology is as important as strategy in investing.

Common Traits of the Greatest Investors

Even though these 12 investors had very different styles—some focused on value, others on growth, some on macro bets, and others on indexing—they shared a set of traits that explain their lasting success.

- Patience

They weren’t chasing quick wins. Whether Buffett holding stocks for decades or Bogle building index funds, they understood wealth grows slowly and steadily. - Discipline

Emotions like fear and greed ruin many investors. The greatest stayed calm during panics and didn’t get swept away by hype. - Independent Thinking

They weren’t afraid to go against the crowd. Soros betting against the pound, or Templeton investing globally before it was popular, showed courage to act differently. - Risk Management

Every one of them respected risk. Some did it by diversifying (Bogle, Dalio), others by using stop-losses or hedging (Livermore, Druckenmiller). But all understood survival was as important as profit. - Continuous Learning

From Munger’s mental models to Fisher’s scuttlebutt method, they all believed in learning, adapting, and improving over time.

Lessons for Everyday Investors

You don’t need billions to apply their wisdom. Here are practical takeaways for regular investors:

- Don’t copy trades—copy principles. You may not have Soros’s ability to predict currency moves, but you can use his discipline in cutting losses.

- Focus on the long term. Like Buffett and Bogle, stay invested and let compounding do its work.

- Keep costs low. Fees eat away at returns. Index funds and ETFs are simple, proven tools.

- Invest in what you know. Lynch’s advice still applies—your own life can give you clues about promising businesses.

- Control your emotions. Market swings are inevitable. Success comes from staying calm and sticking to your plan.

- Diversify. Even the greats made mistakes, but diversification reduced the damage. Don’t bet everything on one stock or sector.

Everyday investors can avoid common pitfalls and build steady wealth over time by blending these lessons.

FAQs

Q1. Who is considered the best investor of all time?

Many consider Warren Buffett the greatest, thanks to his decades of consistent success and his clear philosophy of value investing.

Q2. What books did these investors write or inspire?

- Benjamin Graham wrote The Intelligent Investor and Security Analysis.

- Philip Fisher wrote Common Stocks and Uncommon Profits.

- John Bogle wrote The Little Book of Common Sense Investing.

- Ray Dalio wrote Principles.

These books remain classics for anyone who wants to learn investing.

Q3. Can ordinary investors follow their methods?

Yes, but not all strategies are practical for everyone. For example, most people can’t trade currencies like Soros. But principles like patience, discipline, diversification, and long-term focus are universal.

Q4. What is the difference between value and growth investing?

- Value investing focuses on buying undervalued companies (Buffett, Graham).

- Growth investing looks for companies with strong future potential, even if today’s price seems high (Fisher, Lynch).

Q5. Is index investing really as powerful as stock picking?

Yes. John Bogle proved that low-cost index funds often beat most professional fund managers over the long term. For many everyday investors, indexing is the simplest and most reliable path.

Conclusion

The world’s 12 greatest investors show that there isn’t a single way to succeed in markets. Some built fortunes through value investing, others through global diversification, bold speculation, or simple index strategies. But behind these different paths, the same timeless principles emerge: patience, discipline, risk management, and a willingness to think independently.

Their stories prove that investing isn’t about chasing quick profits—it’s about building wealth steadily, thoughtfully, and with a plan. Whether you lean toward Buffett’s long-term approach, Bogle’s low-cost indexing, or Fisher’s growth strategies, the lesson is clear: success comes from consistency, not luck.

For everyday investors, the takeaway is encouraging. You don’t need billions to invest wisely. By applying the lessons these legends shared—staying patient, controlling emotions, and focusing on the long term—you can build a financial future that stands the test of time.